Discover how to navigate TRACES Login, the portal for tax-related services in India. Learn about the login process for different user types and access valuable insights in this comprehensive guide.

Introduction

Tax-related services in India have become more accessible than ever, thanks to TRACES. This portal simplifies the process of managing your taxes, but the login procedure can vary depending on your user type. In this article, we’ll delve into the intricacies of Traces Login, providing step-by-step guidance and answering your burning questions. Let’s embark on this journey to financial convenience.

what is traces

https://contents.tdscpc.gov.in/

Traces is an online facility provided by the Income Tax Department at www.tdscpc.gov.in. The objective of this facility is to enable both payers and deductors of TDS to view taxes paid online, reconcile them for purposes of filing returns and seeking refunds.

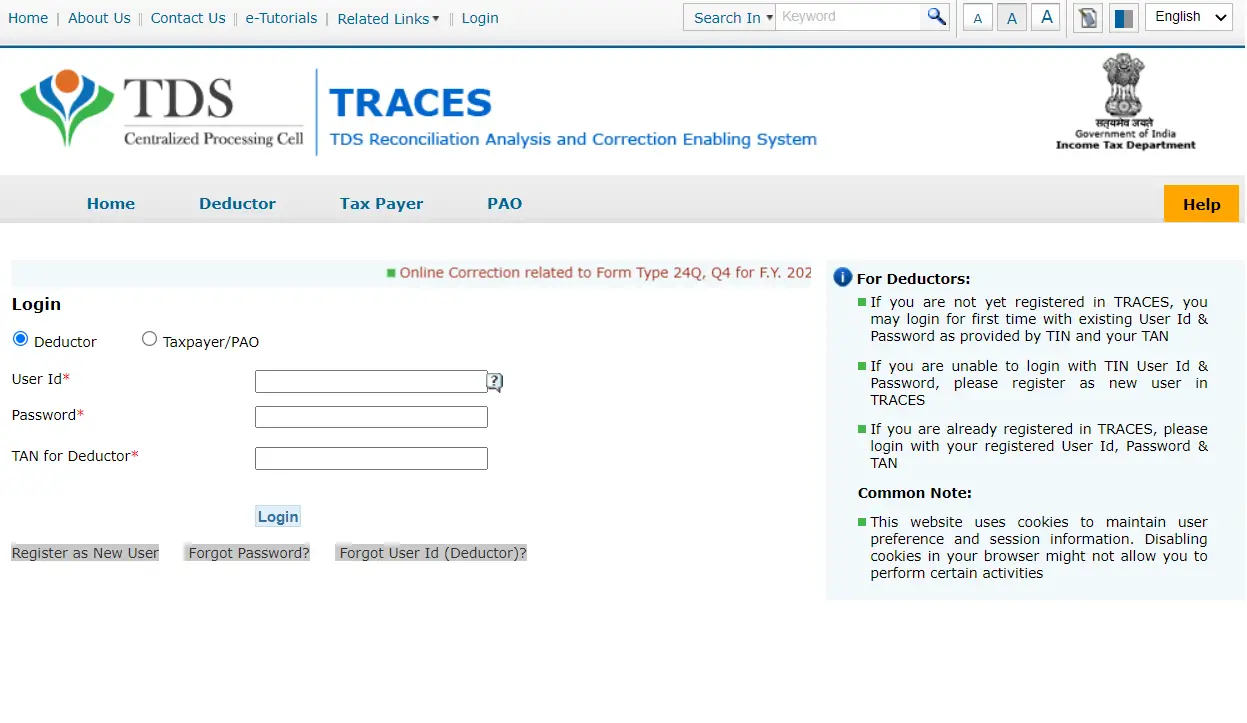

traces login

https://www.tdscpc.gov.in/app/login.xhtml

Go to the traces link https://www.tdscpc.gov.in/app/login.xhtml Then enter your username & password Click on the “login” button.

traces registration

https://contents.tdscpc.gov.in/

For Tax Payers: If you are already registered in TRACES, please login with your registered User Id (PAN), Password & PAN else register.

TRACES 26AS

https://www.incometaxindia.gov.in/Pages/tax-services/online-26AS-traces.aspx

This form contains all information on the tax deducted on your income, It includes the details of the tax collected by collectors.

traces tds

https://nriservices.tdscpc.gov.in/nriapp/tapreg1.xhtml

CPC TDS Portal, Income Tax Returns Correction, If you are already registered in TRACES, please login with your registered User Id.

TRACES 26AS download

https://www.incometaxindia.gov.in/Pages/tax-services/online-26AS-traces.aspx

View Tax Credit Statement (Form 26AS), Perform the following steps to view or download the Form-26AS from e-Filing portal: Logon to ‘e-Filing’ Portal.

traces portal

https://contents.tdscpc.gov.in/

About the portal, TRACES is a web-based application of the Income Tax Department that provides an interface to all stakeholders associated with TDS.

Read Also: