Fapeza is an online platform that enables small-scale farmers in Zambia to access loans and other financial services. As an integral part of the agricultural economy in Zambia, understanding how to navigate the Fapeza system is important for farmers looking to grow their operations. This article will provide an overview of Fapeza, the registration and login process, key features, and tips for accessing financing.

Understanding Fapeza

Fapeza stands for The Citizen Economic Empowerment Commission Fund. It was established by the Zambian government in 2019 to increase financial inclusion and support for farmers and other small business owners. The fund provides access to affordable financing including loans to help these vital entrepreneurial groups expand.

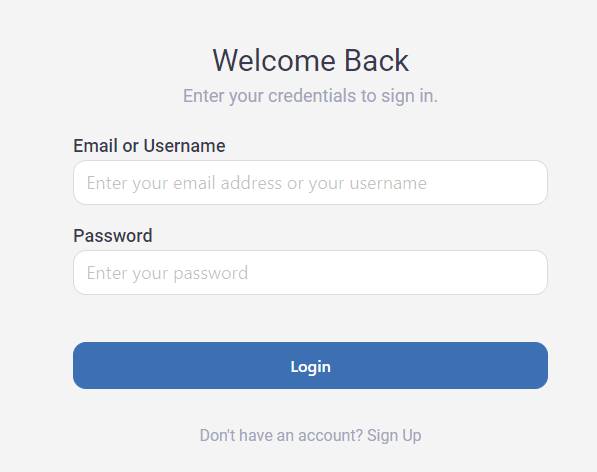

To access Fapeza services, farmers and other potential borrowers must first create an online account. This account allows users to apply for loans, make repayments, and monitor the status of their financing. Creating an account is free and simple, but understanding the login process is key.

Read More: How To Fapeza Login & Guide To Review, Legit or Scam?

Registering for a Fapeza Account

The first step in accessing Fapeza is to register for an account on the official Fapeza website. The registration process requires the following steps:

- Navigate to the Fapeza login page

- Click on “Register”

- Enter your personal details including full name, ID number, phone number and email address

- Create a password

- Agree to the Terms of Service

- Verify your account via SMS code or email

Once registered, you can now login using your email and password credentials. Be sure to choose a strong password and keep it private for account security.

Key Features of the Fapeza Platform

The Fapeza platform offers farmers several useful features including:

Loan Applications

- Apply for agricultural or business loans from 50,000 to 500,000 Kwacha

- Loan terms from 6 months up to 3 years

- Competitive interest rates from 5% per annum

Loan Tracking

- Check current loan details including original amount, balance, interest

- View payment history and receipts

- Receive notifications for upcoming payments

Educational Resources

- Access articles and guides on best practices for farming and business management

- Get financial literacy tips and marketing advice

- Learn about new government initiatives relevant to small business owners

Leveraging these features enables users to not only access financing but also build their capabilities.

Tips for Accessing Fapeza Loans

Here are some top tips for farmers and entrepreneurs looking to get approved for Fapeza loans:

- Maintain an updated business plan – Lenders want to see a viable business strategy that shows how you will repay the loan

- Gather all required documents – This includes national ID, proof of residence, collateral details etc. Incomplete applications cause delays

- Build your credit history – Applicants with good credit have the best chance of qualifying for competitive rates

- Apply for reasonable loan amounts – Asking for too much financing at once may get rejected so build up gradually

- Follow-up frequently – Check inregularly on the status of your pending application and provide any additional details requested promptly

Following these best practices streamlines the underwriting process and boosts the chances your Fapeza loan gets approved.

Leveraging Fapeza Financing for Farm Growth

Access to financing is crucial for unlocking the growth potential of Zambia’s smallholder farms. Fapeza provides farmers an incredible opportunity to invest in assets like irrigation systems, equipment, high quality inputs, and labor. However, effectively utilizing Fapeza loans requires proper planning and execution.

Creating a Growth-Oriented Loan Plan

Before even applying for a Fapeza loan, farmers need to strategically plan out how they will invest the financing. Key elements include:

- Production Expansion Goals – Set target metrics like acres under cultivation, volume produced, yield per hectare

- Equipment Investments – Determine essential equipment like tractors or irrigation systems

- Input Projections – Calculate input costs for upgraded seed varieties and fertilizers

- Infrastructure Improvements – Upgrade storage facilities, drying floors, pack houses

- Labor Cost Analysis – Project additional labor required to support growth

Aligning loan amounts to these tactical growth levers will maximize impact. Too little financing curbs potential while too much debt is risky.

Maintaining Good Financial Hygiene

While Fapeza offers lenient terms for small farmers, late repayments or defaulting can restrict future access to loans. Farmers should:

- Separate business and personal finances – Keepclear records of farming income and expenses

- Stick to loan repayment schedules – Avoid missed or late loan payments by budgeting properly

- Reinvest profits strategically – Surplus capital should fund growth not lifestyle inflation

- Build credit history – Taking and repaying loans helps establish positive creditworthiness

Deploying a Diversified Farm Strategy

Rather than relying on a single crop, farmers can use Fapeza loans to diversify into additional income streams. This mitigates risk and creates multiple revenue channels. Possible options include:

- Food crops – Cultivate maize, millet, or vegetables for local markets

- Cash crops – Enter export crop value chains like tobacco, cotton, or macadamia

- Livestock – Expand cattle, goats, pigs or poultry production

- Agroforestry – Grow high value timber, fruit or fuelwood trees

A diversified farm system provides greater financial stability and flexibility compared to monocropping.

The Future Growth Potential of Fapeza

In the few short years since its launch, Fapeza has already provided thousands of small farmers and entrepreneurs access to financing. However, the platform still has ample room for expansion in terms of beneficiaries reached, loan facilities offered, and adoption of technology.

Reaching More Smallholders

Current estimates suggest Zambia has over 1 million smallholder farms representing huge potential demand for Fapeza loans. Growth strategies to reach more beneficiaries include:

- Opening additional rural loan office locations

- Streamlining paperwork and qualification requirements

- Conducting agricultural loan promotion campaigns

Increasing enrollment will require input financing levels to rise concurrently. Government and private sector support can supplement funding pools.

Expanding Loan Products

The standard Fapeza loans essentially provide working capital for day-to-day operations. By introducing additional loan products aligned to major farm investments, long-term productivity can improve including:

- Asset financing – Loans for farm infrastructure, vehicles, machinery

- Contract farming loans – Facilitate farmer participation in formal supply chains

- Warehouse receipt financing – Loans against commodities stored in certified facilities

Leveraging the Digital Agriculture Revolution

Emerging digital solutions are transforming smallholder agriculture. Fapeza has the opportunity to integrate platforms like farm management apps, IoT sensors, and alternative credit scoring:

- Support IT adoption – Subsidize purchases of smart devices and internet service

- Champion agtech apps – Promote apps for precision input usage, automated advisory, and market linkages

- Facilitate data analytics – Use digital farm records to refine underwriting algorithms and risk models

Technological integration improves productivity and integrity while optimizing lending.

Summary

Access to credit remains one of the most pressing challenges for Zambian smallholder farms and agribusinesses to unlock their full potential. The Fapeza initiative represents an accessible financing avenue for the groups that need it most. By creating free online accounts, farmers and entrepreneurs can apply for short and medium-term capital crucial for business growth.

Responsible planning for loan investment along with consistent repayments and diversified income streams will amplify the benefits of Fapeza financing. With an ever-growing applicant pool still untapped along with expansions into more loan options and digital partnerships, the future remains bright for Fapeza to keep empowering and enriching Zambia’s agricultural entrepreneurs.

Read Also: