Creditspring Login continues to disrupt the UK’s personal finance sector with its transparent, subscription-based lending model. As economic uncertainty and the cost-of-living crisis persist, more borrowers are seeking predictable, ethical alternatives to payday loans and high-interest credit cards.

This article explores the latest developments at Creditspring, addressing each keyword separately, how the platform is changing the way Britons access and manage credit.

What is Creditspring

Creditspring is a UK-based financial service provider offering a unique approach to short-term lending through a membership-based model.

Unlike traditional lenders, Creditspring members pay a fixed monthly or annual fee in exchange for access to two interest-free loans per year, with no hidden charges or spiralling APRs.

The company is regulated by the Financial Conduct Authority (FCA), ensuring robust consumer protection and ethical lending practices.

“Creditspring Login provides a new way to access credit through a model everyone is familiar with: subscription finance,” the company states.

Creditspring Login

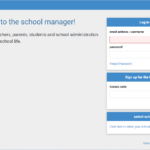

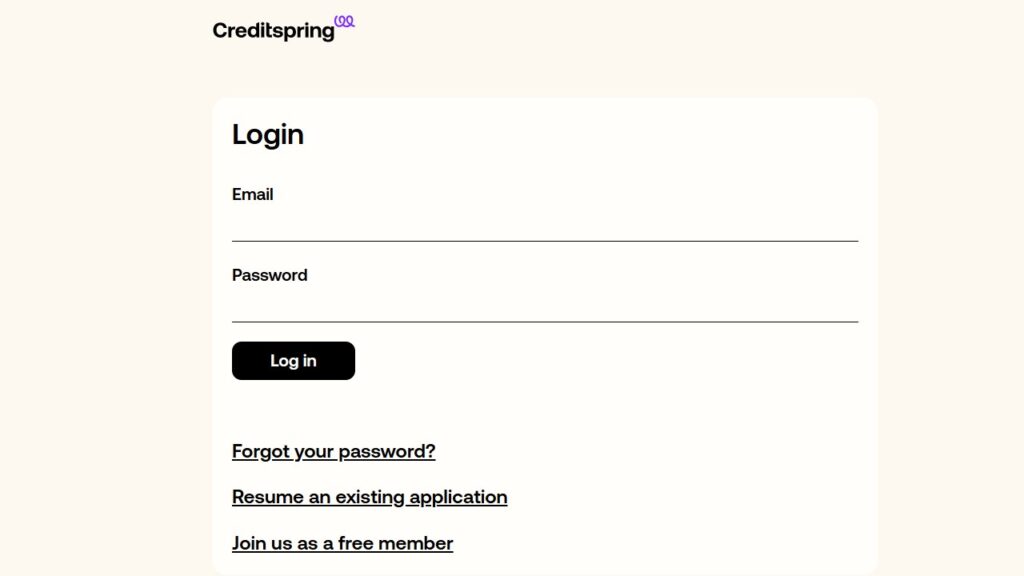

Accessing your Creditspring account is designed to be secure and straightforward.

To Creditspring login:

- Visit the official Creditspring website: https://app.creditspring.co.uk/user_logins/new.

- Click the “Login” button at the top right.

- Enter your registered email address and password.

- Complete any two-factor authentication steps if prompted.

- Click “Submit” to access your dashboard, where you can manage loans, payments, and personal details.

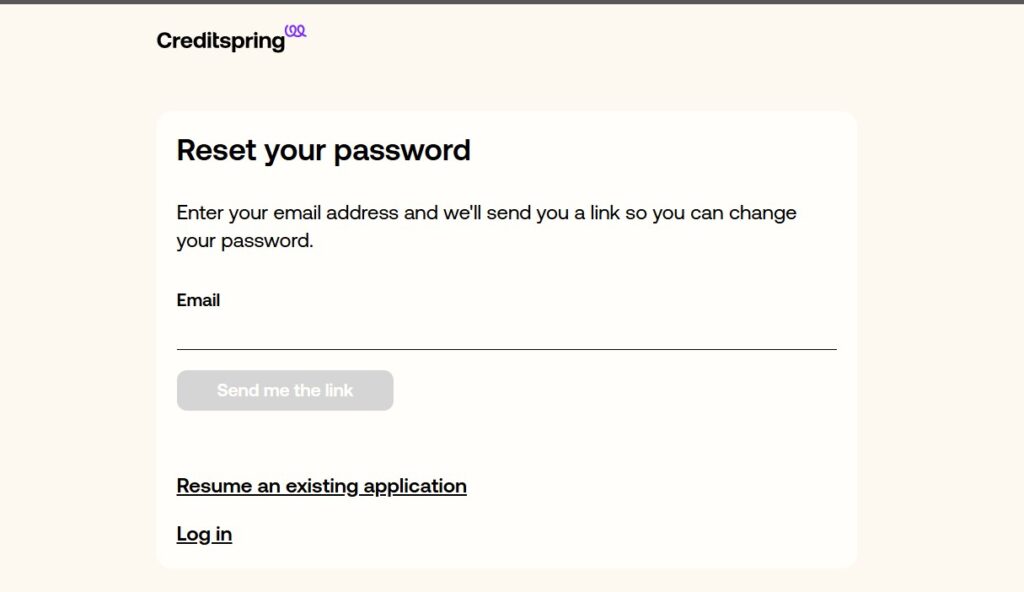

Creditspring Forgot Password

If you’ve forgotten your Creditspring password, the recovery process is simple:

- Go to the Creditspring login page.

- Click on “Forgot Password?”.

- Enter your registered email address.

- Follow the instructions sent to your email to reset your password.

- Create a new, secure password and confirm the change.

This ensures your account remains protected while restoring access quickly.

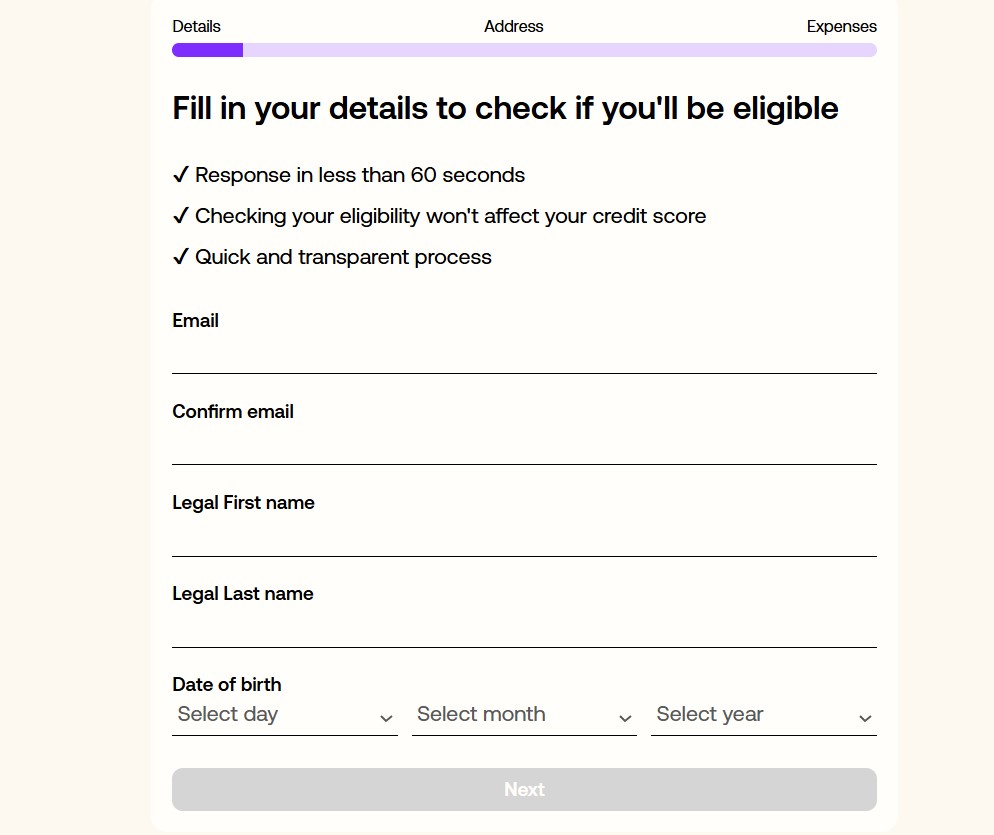

Creditspring Register

Registering for Creditspring is a quick process, designed to determine eligibility and protect your credit score:

- Go to the Creditspring website and click “Apply” or “Register”.

- Enter your personal details (name, address, date of birth, income, employment status).

- Provide your UK bank account details.

- Complete a soft credit check (does not affect your credit score).

- If eligible, review your personalised membership offer.

- Accept the terms and pay your first membership fee.

- After a 14-day cooling-off period, you can access your first loan.

Creditspring Loans For Bad Credit

Creditspring specializes in loans for bad credit, offering short-term, interest-free loans to those who may struggle with traditional lenders.

The platform considers more than just your credit score, assessing overall affordability and recent financial history.

Membership plans are available for those with less-than-perfect credit, but applicants must not have recent bankruptcies or County Court Judgments (CCJs).

“At Creditspring, our loans are available for many people, even if you have bad credit. We consider more than just your credit history when assessing your eligibility,” the company explains.

Creditspring Small Loans: How to Apply

Applying for a small loan from Creditspring is efficient and transparent:

- Use the free eligibility checker on the Creditspring website.

- Complete the short application form with your details.

- Undergo a soft credit check for eligibility.

- If approved, accept your membership offer and pay the fee.

- After the cooling-off period, request your first loan—usually available within 24 hours.

- Repay the loan in six equal monthly instalments.

Loan amounts depend on your membership tier, ranging from two £200 loans per year (Step) to two £1,200 loans per year (Extra).

How Creditspring Works

Creditspring operates on a subscription model: members pay a fixed fee, then access up to two interest-free loans per year.

There are no hidden charges or late payment fees, and the total cost is always clear upfront.

After a soft credit check, eligible members can join, pay their fee, and receive their first loan after a 14-day waiting period.

Once the first loan is repaid, the second becomes available. All repayments are reported to credit agencies, helping members build a positive credit history.

“This model is designed to eliminate the stress of unexpected charges and high-interest rates, offering a transparent and straightforward financial solution,” says a recent industry review.

Why Can’t I get a Loan?

There are several reasons why you might not qualify for a Creditspring loan:

- Poor credit history, recent CCJs, or bankruptcy.

- High existing debt or insufficient income (minimum £14,000 per year required).

- Too many recent credit applications can signal risk to lenders.

- Incomplete or inaccurate application details.

If declined, it’s best to ask for feedback, avoid reapplying immediately, and take steps to improve your credit profile before trying again.

“If your loan application is declined, don’t re-apply straight away. It’s important to know the reason for the decision before you apply again,” Creditspring advises.

Personal Loan Calculator from Creditspring

The Personal Loan Calculator on the Creditspring website allows users to estimate repayments and total costs based on their chosen membership tier and loan amount.

By entering your desired loan and repayment period, you can see exactly what you’ll pay each month—no hidden fees or interest charges.

This transparency helps borrowers make informed decisions and avoid surprises.

creditspring login

https://app.creditspring.co.uk/user_logins/new

Visit the creditspring login link https://app.creditspring.co.uk/user_logins/new Then enter sign in, password. Click on the “login” button

creditspring uk

https://www.creditspring.co.uk/

Created to help with unexpected expenses, Creditspring is a membership loan service that makes borrowing simpler and cheaper for those in the UK.

creditspring bangalore

https://www.creditspring.co.uk/

Creditspring is a way for people to borrow safely, without falling into a spiral of debt. With no hidden fees, members know exactly what they owe upfront.

creditspring contact

https://www.creditspring.co.uk/contact

If you wish to contact us by phone, our number is +44 20 3870 3332. Our working hours are Monday-Friday,

creditspring reviews

https://www.trustpilot.com/review/www.creditspring.co.uk

Creditspring reviews are feedback and opinions from users who have used the Creditspring platform to access affordable loans. These reviews can be found on various websites, including the Creditspring website, Trustpilot, and other review websites.

creditspring jobs

https://www.creditspring.co.uk/

Creditspring may have various job opportunities available in areas such as customer service, finance, marketing, and technology.

creditspring linkedin

https://www.linkedin.com/company/creditspring?originalSubdomain=uk

Created to help with unexpected expenses, Creditspring is a membership loan service that makes borrowing simpler and cheaper for those in the UK. A single financial burden can put anyone in a tough situation where they may find themselves looking at toxic credit options.

creditspring salary

https://www.creditspring.co.uk/

Creditspring is a financial company that provides affordable loans to its users. They offer loans up to £500 at a fixed annual interest rate of 39.9% APR.

creditspring promo code

https://www.codes.co.uk/creditspring

a word or a set of letters and numbers that you can use to get a discount (= a reduction in the usual price) when you buy something, given as a way of encouraging you to buy: Use the promo code “festival” to get a 15% discount on your tickets.

creditspring email address

https://app.creditspring.co.uk/user_logins/new

Sure, the email address for Creditspring is support@creditspring.co.uk. Feel free to contact them if you have any inquiries or need assistance with their services.

creditspring alternative

https://app.creditspring.co.uk/user_logins/new

MoneyLion provides a range of financial products, including personal loans, credit builder loans, and investment options. It also offers a membership program that comes with various perks like cashback rewards and credit monitoring.

creditspring telephone number

https://www.creditspring.co.uk/contact

contact us by phone, our number is +44 20 3870 3332.

creditspring review

https://app.creditspring.co.uk/user_logins/new

Creditspring is a subscription service offering interest-free loans. Instead of paying interest on money borrowed, customers pay a fixed .

Creditspring Reviews

Creditspring reviews are generally positive, with users praising the platform’s transparency and ease of use.

As of early 2025, Creditspring holds a 3.0-star rating on PissedConsumer, with 60% of users likely to recommend the service. Pros include quick loan access and no-interest borrowing.

Some cons cited are membership fees charged even after loan refusal and frustration if a second loan is not approved after repayment.

On Trustpilot, Creditspring is rated “excellent” with over 15,800 reviews.

“Very satisfied with the company and very reasonable, easy to pay off and borrow more. I am very Happy. Thank you,” wrote one user.

Creditspring Contact Us

For customer support, Creditspring offers several contact options:

- Help Centre: The most effective way to find answers and submit queries.

- Live Chat: Available via your customer account.

- Phone: 020 3870 3332 (Monday–Friday, 9am–5pm).

- Email: hq@creditspring.co.uk.

- Address: First Floor, 119 Wardour Street, London, W1F 0UW.

Most customer service issues are resolved quickly, with 82% of callers reaching a real person within three minutes.

FAQs

Is Creditspring regulated by the FCA?

Yes, Creditspring is fully regulated by the Financial Conduct Authority, ensuring ethical lending standards.

Will applying for Creditspring affect my credit score?

No, the initial eligibility check is a soft search and does not impact your credit score. A hard search is only performed if you accept membership.

Can I repay my loan early?

Yes, you can repay your Creditspring loan early without penalty.

What happens if I miss a payment?

Creditspring does not charge late fees, but missed payments are reported to credit agencies and may affect your credit score.

How quickly will I receive my loan?

Once eligible, funds are usually transferred within 24 hours of your request, between 8am and 8pm, seven days a week (excluding bank holidays).

“Creditspring’s transparent, subscription-based lending is a game-changer for UK borrowers, offering predictable costs and ethical access to credit when it’s needed most.”

As the demand for fair, flexible borrowing grows, Creditspring’s model is poised to remain a leading choice for those seeking financial stability and peace of mind.

See Also: