The Ereg.pajak.go.id Login website allows taxpayers in Indonesia to file and report their taxes online. It is operated by the Directorate General of Taxes (DGT).

In 2025, the Directorate General of Taxes (DJP) in Indonesia launched Coretax DJP, a new platform designed to streamline tax services for individuals and businesses. This system replaces previous tax management systems, offering a more efficient way to handle tax payments, returns, and other related services. The Coretax DJP portal, accessible at coretaxdjp.pajak.go.id, is now the primary tool for taxpayers in Indonesia. Let’s explore how to use this platform effectively.

what is coretaxdjp.pajak.go.id?

https://coretaxdjp.pajak.go.id/home-portal/en-US/

Coretax DJP is an integrated system that provides a wide range of tax services, including tax registration, billing code creation, tax payments, and tax return submissions.

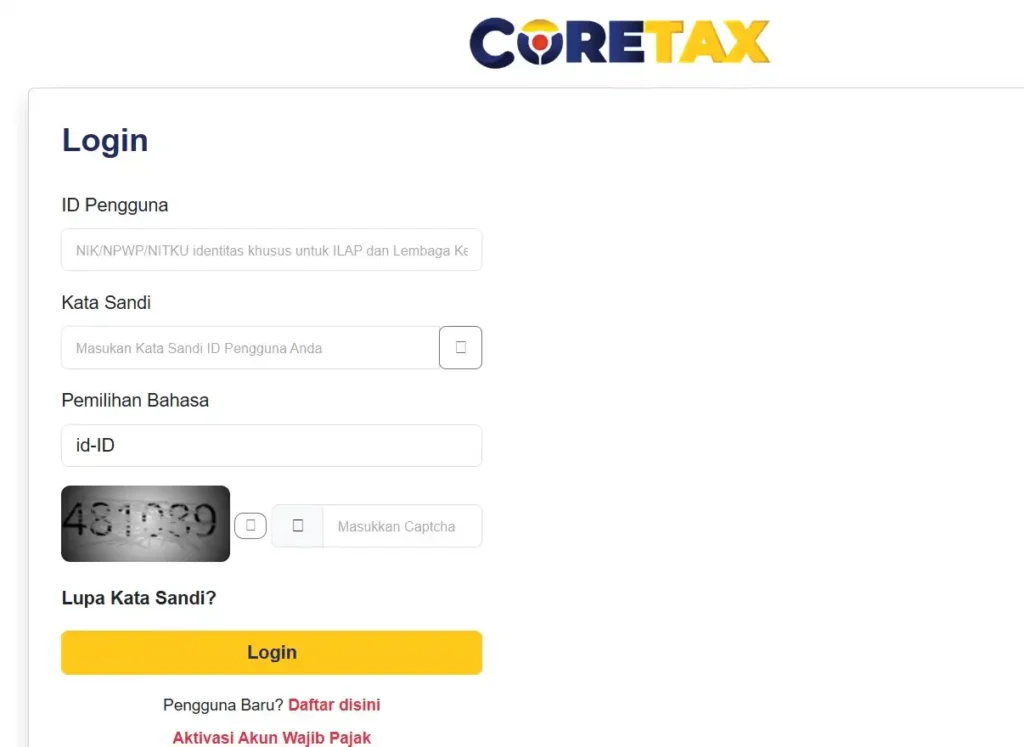

coretaxdjp.pajak.go.id login

https://coretaxdjp.pajak.go.id/identityproviderportal/Account/Login?

1.Visit the coretaxdjp.pajak.go.id Login Website:https://coretaxdjp. 2. Click on the “Login” button 3. Enter your username (NPWP or username) 4. Enter your password 5. Click the “Login” button

coretaxdjp.pajak.go.id daftar

https://www.pajak.go.id/coretaxdjp

“Coretax DJP” refers to the Core Tax system of the Indonesian Directorate General of Taxes (Direktorajat Jenderal Pajak, DJP). The website “(link unavailable)” is likely a portal for taxpayers to access various tax-related services.

coretaxdjp.pajak.go.id registrasi

https://www.pajak.go.id/coretaxdjp/

The “Registrasi” (Registration) feature on the Coretax DJP website ((https://www.pajak.go.id/coretaxdjp/)) is likely used for creating a new account or registering as a taxpayer in the Indonesian tax system.coretaxdjp.pajak.go.id cek npwp

https://www.pajak.go.id/coretaxdjp/

The “Cek NPWP” (Check NPWP) feature on the Coretax DJP website ((link unavailable)) allows you to verify and check the status of your Taxpayer Identification Number (NPWP).

coretaxdjp.pajak.go.id registration

https://coretaxdjp.pajak.go.id/registration-

1. Visit the Coretax DJP website: (https://coretaxdjp.pajak.go.id/registration-) 2. Click on the “Registrasi” button. 3. Select your registration type (e.g., individual, business, or tax consultant). 4. Fill in the required information, including your NPWP number, name, address, email, and phone number. 5. Upload the required documents. 6. Create a username and password for your account. 7. Review and confirm your registration information. 8. Submit your registration application.

ereg.pajak.go.id login

https://ereg.pajak.go.id/login;eregsid=UU4jUPL4RdLHbC3O+sgmGgSA

Go to https://ereg.pajak.go.id/login and click “daftar” to register. Register your active email account. Check your email for verification and follow the instructions. Go to https://ereg.pajak.go.id/login and login with your email.

www.ereg.pajak.go.id daftar online

https://ereg.pajak.go.id/daftar

www.ereg.pajak.go.id daftar online adalah layanan yang disediakan Direktorat Jenderal Pajak (DJP) untuk mendaftarkan diri sebagai Wajib Pajak dan mendapatkan Nomor Pokok Wajib Pajak (NPWP) secara online melalui situs www.ereg.pajak.go.id.

ereg.pajak.go.id daftar npwp online

https://ereg.pajak.go.id/daftar

Demikian penjelasan singkat mengenai cara mendaftar dan mendapatkan NPWP secara online melalui ereg.pajak.go.id.

ereg.pajak.go.id cek npwp

https://ereg.pajak.go.id/ceknpwp

ereg.pajak.go.id cek npwp adalah layanan yang disediakan oleh Direktorat Jenderal Pajak (DJP) Indonesia untuk melakukan pengecekan status NPWP (Nomor Pokok Wajib Pajak) secara online.

ereg.pajak.go.id login npwp

https://ereg.pajak.go.id/

Visit the website and click on “Login” to access your account. Enter your email and password that you used during the registration process. Once logged in, you can proceed with the NPWP registration process by providing the required information and following the subsequent steps.

ereg.pajak.go.id Reset Password

https://ereg.pajak.go.id/resetPassword

On the login page, click on the “Lupa Password” link below the login fields. You will be taken to the reset password page. Enter your NPWP and the captcha code shown. Click on “Kirim”. This will send a reset password link to your email. Open the email and click on the reset link provided.

ereg.pajak.go.id error

https://ereg.pajak.go.id/

The search results did not provide specific information about an error related to ereg.pajak.go.id. If you are experiencing an error on the website, it is recommended to contact the support team for the online tax registration (NPWP) at Direktorat Jenderal Pajak (DJP) for assistance in resolving the issue.

See Also: