high-risk merchant account at HighRiskPay.com has surged as more businesses in regulated or volatile sectors seek reliable payment processing.

This article explores every aspect of the high-risk merchant account at HighRiskPay.com, from its definition and benefits to application steps, pricing, and legitimacy, ensuring business owners make informed decisions in a rapidly evolving financial landscape.

What is a High-Risk Merchant Account at HighRiskPay.com

A high-risk merchant account at HighRiskPay.com is a specialized payment processing solution designed for businesses that traditional banks or processors consider risky.

These risks may stem from industry type—such as entertainment, travel, or telemarketing—or from business models with higher chargeback rates, regulatory scrutiny, or poor credit histories.

With a high-risk merchant account at HighRiskPay.com, businesses can securely accept credit and debit card payments, access fraud prevention tools, and benefit from advanced chargeback management.

“A high-risk merchant account at HighRiskPay.com allows even the most challenged businesses to participate in the digital economy, leveling the playing field,” says a financial analyst.

High-Risk Merchant Account at HighRiskPay.com Login

To access your high-risk merchant account at HighRiskPay.com, follow these secure steps:

- Navigate to the official HighRiskPay.com website.

- Click the “Login” button at the top right corner.

- Enter your registered email address or user ID and password.

- Complete any two-factor authentication if prompted.

- Access your merchant dashboard to manage transactions, view analytics, and monitor chargebacks.

This login process ensures that only authorized users can manage sensitive payment data, a critical feature for any high-risk merchant account at HighRiskPay.com.

High-Risk Merchant Account at HighRiskPay.com Forgot Password

If you forget your high-risk merchant account at HighRiskPay.com password, the platform provides a secure recovery process:

- Go to the HighRiskPay.com login page.

- Click “Forgot Password?” below the login form.

- Enter your registered email address.

- Follow the link sent to your email to reset your password.

- Set a new, strong password and confirm.

This process is designed to protect your high-risk merchant account at HighRiskPay.com from access while ensuring you regain control quickly.

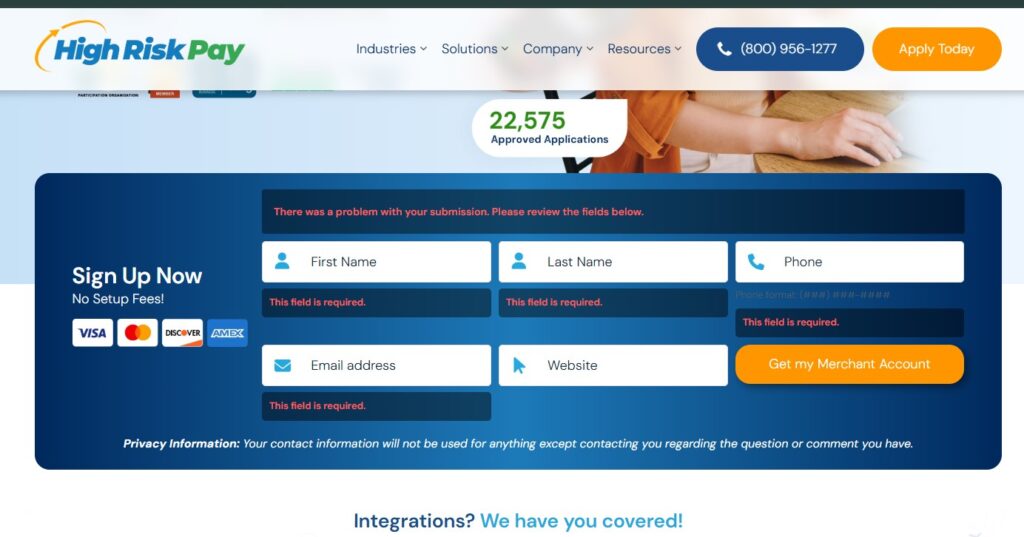

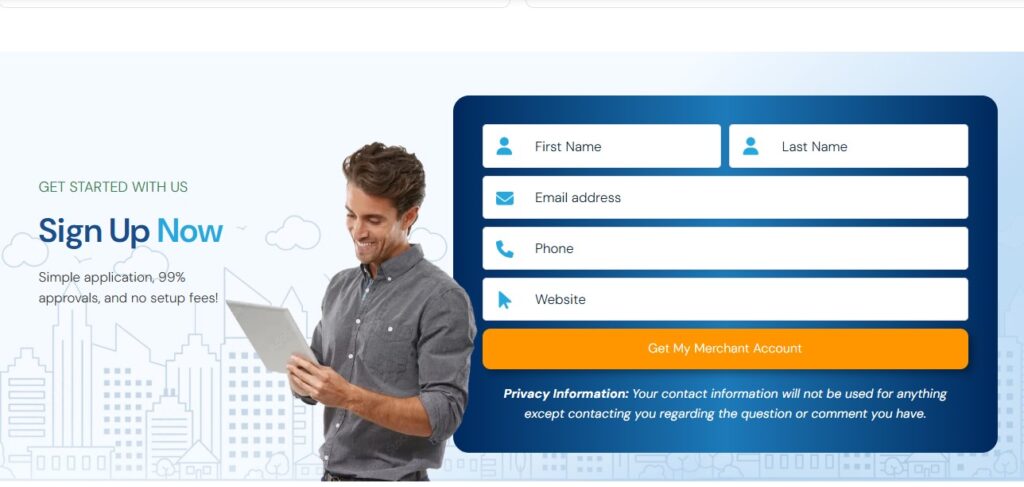

High-Risk Merchant Account at HighRiskPay.com Register

Registering for a high-risk merchant account at HighRiskPay.com is straightforward but requires detailed information due to regulatory standards:

- Visit HighRiskPay.com and click “Apply Now” or “Sign Up”.

- Fill in your business name, contact details, website URL, and industry type.

- Upload supporting documents, such as business verification certificates, ID, and proof of address.

- Review and sign the application electronically via DocuSign.

- Submit your application for underwriting and risk assessment.

Most applications for a high-risk merchant account at HighRiskPay.com are reviewed within 24-48 hours, with a 99% approval rate for eligible businesses.

High-Risk Merchant Account at HighRiskPay.com App Login

While HighRiskPay.com primarily operates through a web portal, users can access their high-risk merchant account at HighRiskPay.com via mobile browsers.

The login steps mirror the desktop experience:

- Open your mobile browser and go to HighRiskPay.com.

- Tap the “Login” button.

- Enter your credentials and complete any security prompts.

- Manage your high-risk merchant account at HighRiskPay.com on the go.

This flexibility ensures that business owners can monitor transactions and respond to chargebacks from anywhere.

High-Risk Merchant Account at HighRiskPay.com App Download

Currently, there is no standalone mobile application for the high-risk merchant account at HighRiskPay.com.

However, the website is fully optimized for mobile use, allowing seamless access and management of your account from any device.

The company has hinted at future mobile app development as demand for on-the-go payment management grows.

High-Risk Merchant Account at HighRiskPay.com Legal

The high-risk merchant account at HighRiskPay.com is operated by a legitimate U.S.-based company specializing in high-risk payment solutions.

The provider acts as an Independent Sales Organization (ISO) and partners with acquiring banks to support businesses in challenging sectors.

All operations comply with PCI DSS security standards, and the company has received positive reviews for its transparent practices and robust customer support. “HighRiskPay.com is very likely not a scam but legit and reliable,” according to Scamadviser.

High-Risk Merchant Account at HighRiskPay.com Review

Reviews for the high-risk merchant account at HighRiskPay.com are generally favorable, emphasizing high approval rates, fast onboarding, and support for businesses with bad credit or in restricted industries.

Customers appreciate the absence of setup fees, next-day funding, and responsive support.

However, some note that fees are higher than standard merchant accounts, reflecting the increased risk profile.

“The platform’s design and functionality make it easy for users to manage their accounts, access customer support, and stay informed about their transactions,” says a recent industry review.

High-Risk Merchant Account at HighRiskPay.com Contact

For assistance with your HighRiskPay.com, use these contact options:

- Website: HighRiskPay.com (contact form available)

- Phone: Listed on the official site for direct support

- Email: Provided upon registration or via the support page

- Live Chat: Available during business hours for quick queries

The customer support team is known for its expertise in high-risk sectors and provides guidance on applications, compliance, and risk management.

FAQs

Who needs a high-risk merchant account at HighRiskPay.com?

Businesses in industries with high chargeback rates, regulatory scrutiny, or poor credit—such as entertainment, travel, or e-commerce—benefit most from a HighRiskPay.com.

How long does approval take for a HighRiskPay.com?

Most applicants receive a decision within 24-48 hours, thanks to streamlined for HighRiskPay.com.

What are the fees for a HighRiskPay.com?

Fees start at 2.95% plus $0.25 per transaction, with a monthly minimum of $9.95. Rates may be higher for certain high-risk industries.

Is my data secure with a HighRiskPay.com?

Yes, all accounts are protected by PCI DSS compliance, encryption, and fraud prevention measures.

What documents are required for a HighRiskPay.com?

Applicants must provide business verification, government-issued ID, proof of address, and sometimes financial statements.

“A high-risk merchant account at HighRiskPay.com empowers businesses in challenging sectors to thrive, offering secure, compliant, and reliable payment processing,” says a leading industry expert.

As the digital economy expands, the high-risk merchant account at HighRiskPay.com remains a vital resource for entrepreneurs facing rejection from traditional providers.

With transparent pricing, rapid approvals, and tailored support, it stands out as a top choice for high-risk merchants in 2025.

See Also: