Having easy access to your credit card account is vital to monitoring your finances and making timely payments. My AvantCard Login gives users the convenience and security of managing their Avant credit card accounts digitally.

By signing up for online account access, customers can check balances, view transactions, set alerts, make payments and much more.

Using MyAvantCard Login means you have more control over your account activity and spending. Signing up is quick and easy and lets you manage your Avant credit card seamlessly.

What is My Avantcard

“Avantcard” is a credit card provided by a financial services company called Avant. Avant Credit Card is an unsecured credit card designed for people who have average credit scores or limited credit history.

This card has an easy application process, a credit limit of $300 to $3,000, and annual membership fee ranges from $0 to $75.

Its annual percentage rate ranges between 29.24% to 35.24%, and checking whether you qualify or not has no impact on your credit score.

To apply for an Avant Credit Card you can visit Avant’s website and follow a simple 3-step process to qualify.

My Avantcard Login

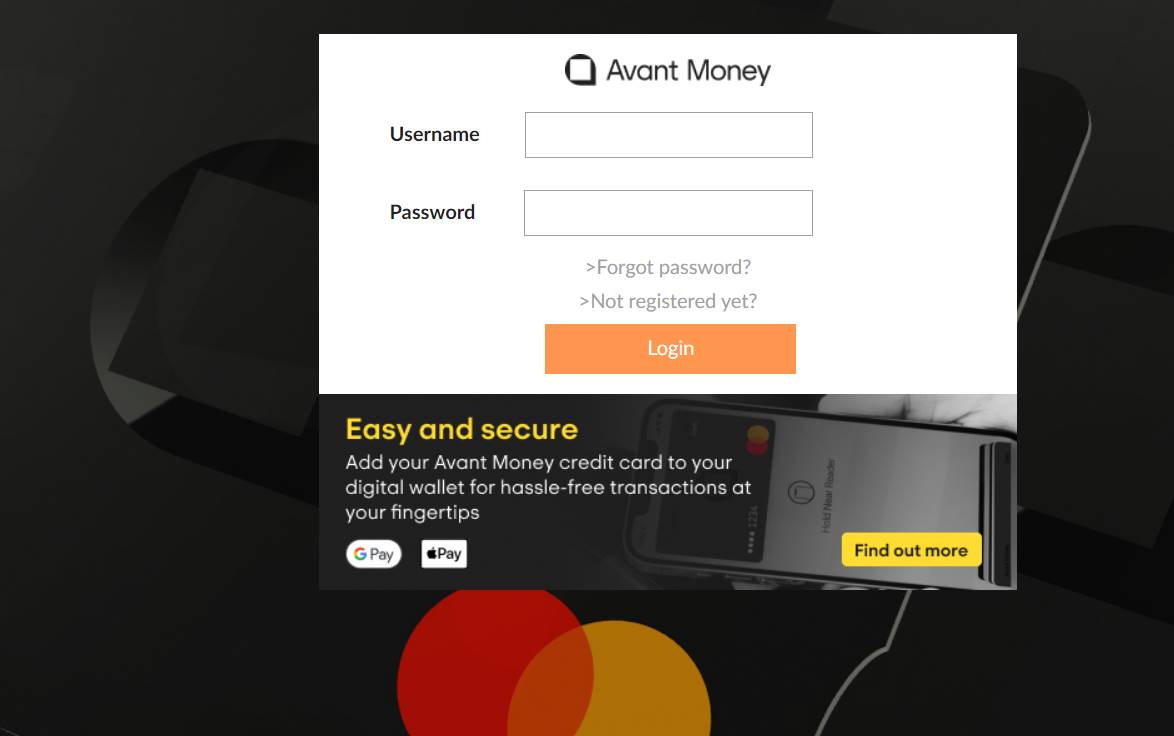

To login to your Avantcard account, follow these steps:

- Create a My Avant Money account: If you haven’t created one yet, go to the Avant website, click on “ Apply Avant Credit Card ” and create a username and password.

- Avant Money app download karo: App Store ya Google Play se Avant Money app download karo.

- Login to your account: Open Avant Money app and login to your account by entering your username and password.

If you have any problems logging in, you can find troubleshooting steps on the AvantLink Support page. And if you need to activate your Avantcard, you can do so by visiting the Avant website or calling 1-855-752-7011.

To login directly to the Avant website, go to avant.com and click “ Log In ” on the upper right. Enter your username and password on the login page.

If you have forgotten your username or password, you can reset your credentials by clicking on the links on the login page. You will need to provide identifying information to verify your identity.

How to Apply for an Avantcard

Applying for My Avantcard is a very easy and online process. Here are the steps to apply:

- Go to avant.com and click “Apply Now” on the My Avantcard page.

- Provide your basic personal information such as name, address, date of birth, and Social Security number so that Avant can get your credit report.

- Review the terms and conditions and submit the application.

- If it is approved then income and identity verification will have to be done.

- Once it is verified, you can activate your card and set up online account access.

If you have all the information ready, the entire application process is completed in just 10 minutes. The key eligibility requirements for My Avantcard are:

- Your age should be at least 18 years

- Must have a valid Social Security number

- Individual income should be at least $12,000

Checking your rates or submitting an application does not affect your credit score. Avant Soft will do a credit inquiry before you apply to estimate your chances of approval.

If approved, you will get a credit limit of $300 to $3,000 depending on your qualifications. No security deposit is required.

My Avantcard App

The My Avantcard app lets you manage your credit card account conveniently from your mobile device. Youcan download the Avant Money app for free from the App Store (for iOS) or Google Play (for Android) .

With the Avant Money mobile app you can:

- You can check your account balance

- You can see recent transactions

- can I make payment via credit card

- You can set alerts and notifications

- You can freeze/unfreeze your card

- You can contact customer support

- You can access your credit score

- Statements and other documents can be reviewed

The app has biometric authentication with fingerprint or facial recognition so that you can access quickly and securely. You can also enable transaction notifications so that you are updated about your account activity.

Overall, the My Avantcard mobile app makes it very easy to manage your account, make payments, track spending and use key features no matter where you are. The app helps cardholders closely monitor their accounts and develop healthy credit card habits.

My Avantcard Payment

There are several safer ways to make credit card payments with Avant:

Online Payment

The easiest way is to login to avant.com and use the “Make a Payment” feature. You can pay the entire balance or custom payment amount from your bank account.

Phone Payment

Call 1-800-712-5407 and follow the prompts so you can make payment over the phone. Have your account number, payment amount and banking details ready.

Other Payment Options

You can also pay via PayPal, Western Union, or MoneyGram. Visit avant.com/pay for details.

The payment due date is each month based on your statement closing date. The minimum payment is 2.5% of your balance or $15 whichever is higher.

Same day and next day payment services are not available. Payments received before 5:00 pm CT will be credited on the same day.

If you can’t afford the minimum payment, immediately contact Avant customer service and discuss alternative arrangements. Late, partial, or missed payments can negatively affect your credit score.

Conclusion

My Avantcard can be a handy tool to establish or rebuild your credit. Applying for this card online is very easy and offers the flexibility of a revolving credit line.

Online account access, mobile app management, reporting to credit bureaus, and facilities to increase credit lines help cardholders effectively build their credit.

Making timely payments, keeping balances low, and avoiding late fees are key to making the best use of this card. Check your eligibility and apply if you need a starter card to build your credit history.

If you use this card mindfully then in some time it will help you in improving your credit and accessing better financing options.

Read Also: