NS&I Login, also known as National Savings and Investments, allows individuals to manage their savings and investments securely online. Logging in to your NS&I account is simple, but recent changes have strengthened security protocols for optimal protection of your finances.

In this comprehensive guide, we’ll explore the ins and outs of NS&I Login, from registering your account to setting up two-factor authentication.

An Overview of NS&I

NS&I is a savings organization backed by HM Treasury that offers a range of savings and investment products to UK residents. These products include premium bonds, direct saver accounts, and income bonds.

The key benefits of choosing NS&I for your savings include:

- 100% security on all deposits since NS&I is government-backed.

- Tax-free returns on some products.

- Easy access to your money.

- Friendly customer service.

By creating an online NS&I account, you can manage your savings conveniently via desktop or mobile app.

How to Login to Your NS&I Account

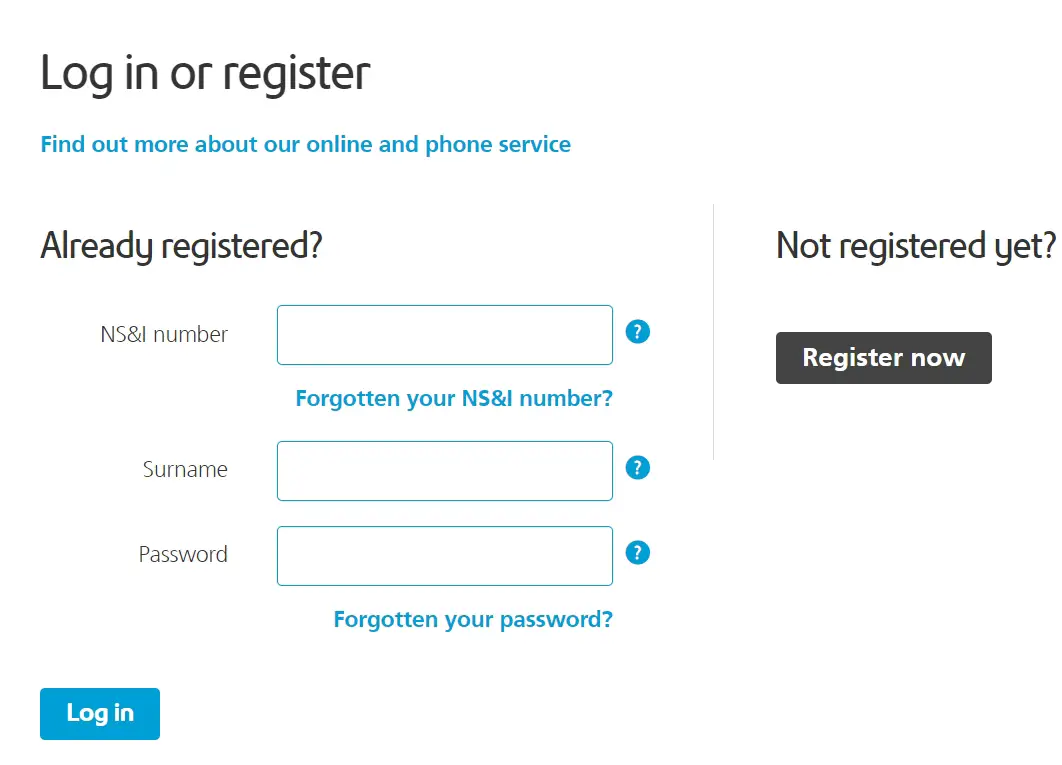

Logging in to your NS&I Login is simple if you follow these steps:

- Go to www.nsandi.com and click ‘Log in’ on the top right.

- Enter your NS&I number or username on the login page.

- Input your password.

- Follow the prompts for two-factor authentication.

Once logged in, you’ll be able to view your account details, transfer funds, update personal information, and more.

Do note that NS&I has enhanced login security recently, so two-factor authentication is mandatory. Don’t worry if you face any issues while logging in – NS&I provides ample help resources.

Creating an NS&I Account Online

If you don’t have an NS&I account yet, registering online is quick and convenient. Follow these steps:

- Go to the ‘Register’ page on nsandi.com.

- Fill in the registration form with your personal details like name, address, contact information.

- Provide your bank account details for transfers.

- Enter details of any existing NS&I accounts if applicable.

- Follow the instructions to complete registration.

Once registered, NS&I will set up your online account automatically, enabling you to manage your savings seamlessly.

Registering for an NS&I Account by Post

For those who prefer traditional postal communication, registering your NS&I account by post is also an option. Here’s what to do:

- Download the postal registration form from nsandi.com.

- Fill in all required personal and financial details accurately.

- Sign and date the completed form.

- Mail it to the address given on the form.

On receiving your documents, NS&I Login will create your online account. However, any existing Investment Accounts you have cannot be managed online currently.

Securing Your NS&I Account with 2-Factor Authentication

Maintaining robust security for your NS&I account is crucial. This is why 2-factor authentication (2FA) is now mandatory for all accounts.

With 2FA, you need to provide two forms of identification when logging in – your password plus an additional code sent to your phone or email. This prevents unauthorized access significantly.

Follow NS&I’s guidelines carefully when setting up 2FA. Don’t share any verification codes received with unknown sources.

Managing Your NS&I Account and Savings

By creating an online NS&I account, you can manage your savings conveniently via desktop or mobile app. Here are some key features:

- Dashboard – View balances across all your NS&I accounts and products in one place.

- Statements – Access monthly digital statements for each product.

- Secure messaging – Communicate safely with NS&I via the portal.

- Withdraw funds – Withdraw money from your accounts seamlessly.

- Update details – Change personal, contact or bank account information easily.

- Track applications – Check the status of product applications.

- Premium Bonds – Manage Bonds, view prize history and more.

NS&I Account Options for Different Needs

NS&I offers a diverse range of savings and investments suitable for all needs:

- Direct Saver – An easy-access account with competitive interest rates.

- Investment Account – Fixed-term investments providing guaranteed returns.

- Income Bonds – Long-term taxable bonds giving monthly income.

- Premium Bonds – Save while being in the running to win prizes.

- Junior ISA – Tax-free savings account for children.

- Children’s Bonds – Locked savings bonds with tax-free returns for kids.

Choose the right mix of products to meet your savings goals with NS&I.

Alternatives to Consider for Savings and Investments

While NS&I is a solid choice, here are some other options to consider:

- Banks – Savings accounts and fixed deposits from leading banks.

- Credit unions – Member-owned financial cooperatives offering competitive rates.

- Peer-to-peer lending – Earn interest by lending to individuals through platforms.

- Stocks and shares – Invest in the stock markets for potentially higher gains.

- Lifetime ISAs – Long-term savings accounts with a government bonus.

Do your research to find the right fit for your risk appetite and financial objectives.

Secure Your Finances for the Future with NS&I

Managing your savings and investments online is now safer than ever with NS&I’s robust security protocols including mandatory 2FA. Follow this guide to seamlessly register for and log into your NS&I Login.

Harness the convenience of managing your Premium Bonds, Investment Accounts, and other NS&I products via desktop and mobile. With government-backed security and competitive returns on savings, NS&I Login helps grow your hard-earned money. Sign up today to take control of your finances for a stress-free future!

NS&I Premium Bonds login

https://secure.nsandi.com/thc/policyenforcer/pages/loginB2C.jsf

Logging in to your NS&I account is a vital step in managing your Premium Bonds effectively. Once you access your account, you can view your bond holdings, check the results of the monthly prize draws, and update your personal information. It also allows you to reinvest your winnings, giving you more opportunities to win in future draws.

NS&I prize checker

https://www.nsandi.com/prize-checker

NS&I (National Savings and Investments) offers an exciting and secure way to grow your savings with Premium Bonds. These bonds provide the chance to win tax-free prizes in monthly prize draws.

NS&I contact number

https://www.nsandi.com/contact-us

Call us. Call us free on 08085 007 007. Our virtual assistant can help you with general queries 24/7.

NS&I savings bonds for over 65

https://www.nsandi.com/

NS&I Savings Bonds for over 65s are a type of fixed-term investment designed exclusively for individuals aged 65 and above. These bonds offer a competitive interest rate and the reassurance of being backed by the UK government, making them a popular choice among seniors seeking a stable and low-risk investment option.

NS&I interest rates

https://www.nsandi.com/interest-rates

Interest rates play a pivotal role in determining the attractiveness of savings and investment products. When considering investing in NS&I products, understanding the interest rates is essential as it directly affects the return on your investment. The interest rates offered by NS&I are competitive and often linked to prevailing market rates, making them an appealing option for many investors.

NS&I app

https://apps.apple.com/gb/app/ns-i/id1465077416

The NS&I App is a mobile application that allows users to access their NS&I accounts and perform various financial tasks using their smartphones or tablets.

ns&i bonds

https://www.nsandi.com/

NS&I Bonds are financial products offered by the UK government through NS&I. They come in different variations, each tailored to meet the diverse needs of investors. The primary characteristic of NS&I Bonds is that they are backed by Her Majesty’s Treasury, making them one of the safest investment options available.

ns&i wiki

https://en.wikipedia.org/wiki/National_Savings_and_Investments

NS&I was originally created under the name “Post Office Savings Bank” in 1861. Its primary goal was to encourage a culture of saving among the working class and to provide a secure place for them to deposit their money. Over the years, the institution evolved and expanded its offerings, becoming National Savings in 1969, and later rebranding as NS&I in 2002.

Read More: