As an employer in Malaysia, you have important responsibilities when it comes to your employees’ social security protection. Registering with SOCSO (Social Security Organisation) and making regular contributions for your workers is compulsory under the law. To efficiently manage these obligations, you can login to SOCSO’s online portal using the Socso Employer Login.

This provides convenient access to submit contributions, file accident reports, update company details and more. This article will guide you through the complete process of registering and logging in to the SOCSO online portal as an employer.

It covers eligibility criteria, registration steps, login credentials, available services and tips to securely access your Socso employer account online.

what is socso employer?

https://www.perkeso.gov.my/en/

The principal and immediate employers who employ one or more employees are responsible to register and contribute to Social Security Organisation (SOCSO) based on the rates specified under the Employees’ Social Security Act, 1969, administered by SOCSO.

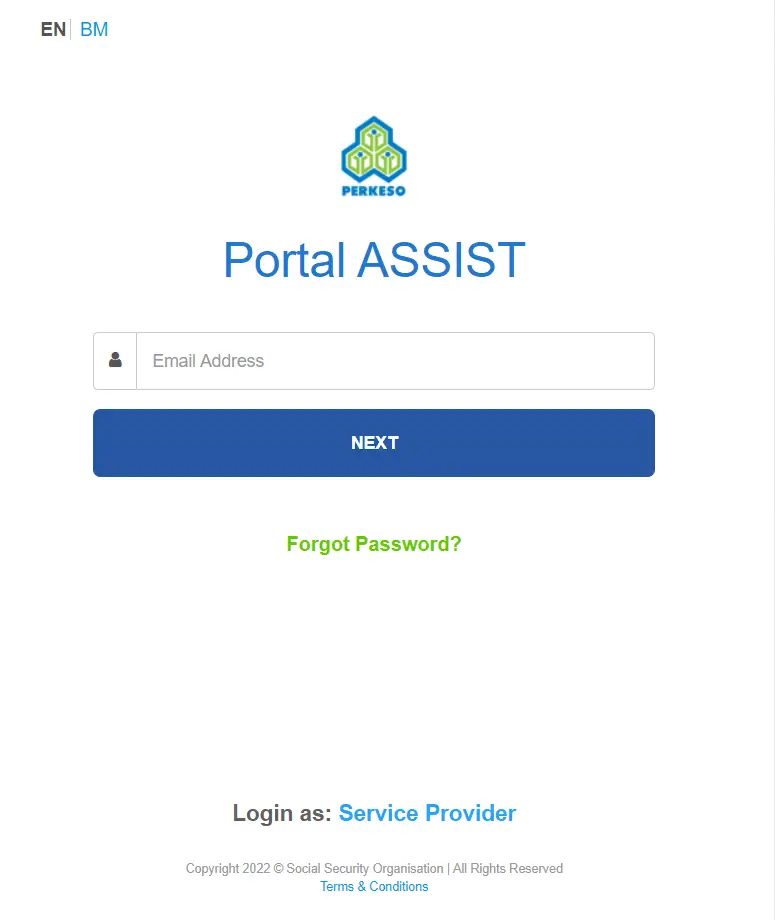

socso employer login

https://assist.perkeso.gov.my/employer/login

Visit the socso employer login link https://assist.perkeso.gov.my/employer/login Then enter sign in, password. Click on the “login” button

socso employer registration

https://www.perkeso.gov.my/en/our-services/employer-employee/registration.html

New employer and employee must be registered with SOCSO within 30 days upon hiring a new employee. For registration purpose, an employer is required to complete the Employer’s Registration Form (Form 1) and Employee’s Registration Form (Form 2) alongside other online documents in the ASSIST Portal.

socso employer contribution

https://www.perkeso.gov.my/en/

The percentage of SOCSO Contribution shall between 3% to 5% of the employee salary vary accordingly to the employee salary amount.

socso employer and employee contribution

https://www.perkeso.gov.my/en/rate-of-contribution.html

The employee and the employer each contribute 12% of the employee’s basic salary and Dearness Allowance (DA) towards the scheme. While the entire contribution of the employee goes towards EPF, only 3.67% of the employer’s share goes towards EPF, while the remaining is contributed towards EPS.

socso employer code number

https://www.perkeso.gov.my/en/

Your SOCSO number is the same as your IC number if you are a Malaysian resident. If you want to confirm your SOCSO number, you can call the agency’s hotline at 1-300-22-8000. You can also talk to a representative through the PERKESO website.

socso employer contribution percentage

https://www.perkeso.gov.my/en/

The percentage of SOCSO Contribution shall between 3% to 5% of the employee salary vary accordingly to the employee salary amount.

socso employer contribution 2022

https://www.perkeso.gov.my/en/

The contribution rate for employers to the Social Security Organization (SOCSO) in 2022 will depend on the employee’s salary.Monthly salary up to RM 1,200: 1.75% Monthly salary between RM 1,201 to RM 2,000: 2.25% Monthly salary above RM 2,000: 2.75%

socso employer number

https://www.perkeso.gov.my/en/

Note: For further clarification on definition of wages, kindly contact our SOCSO offices or Customer Service Careline at 1 300 22 8000.