Accutrac Factoring, Also Known As Accutrac Capital, Is A Prominent Factoring Company Specializing In Providing Financial Solutions To The Trucking And Freight Industries. The Company Focuses On Offering Freight Factoring Services, Which Help Trucking Companies Manage Their Cash Flow By Converting Their Invoices Into Immediate Cash. This Service Is Particularly Beneficial For Businesses That Need Quick Access To Funds To Cover Operational Costs, Such As Fuel, Maintenance, And Payroll.

What is Accutrac Factoring?

Accutrac Factoring is a financial services company that provides factoring services to small and medium-sized businesses. It is a family-owned business that has operated for over 20 years. Accutrac Factoring is a member of the International Factoring Association and adheres to the highest ethical standards in the industry.

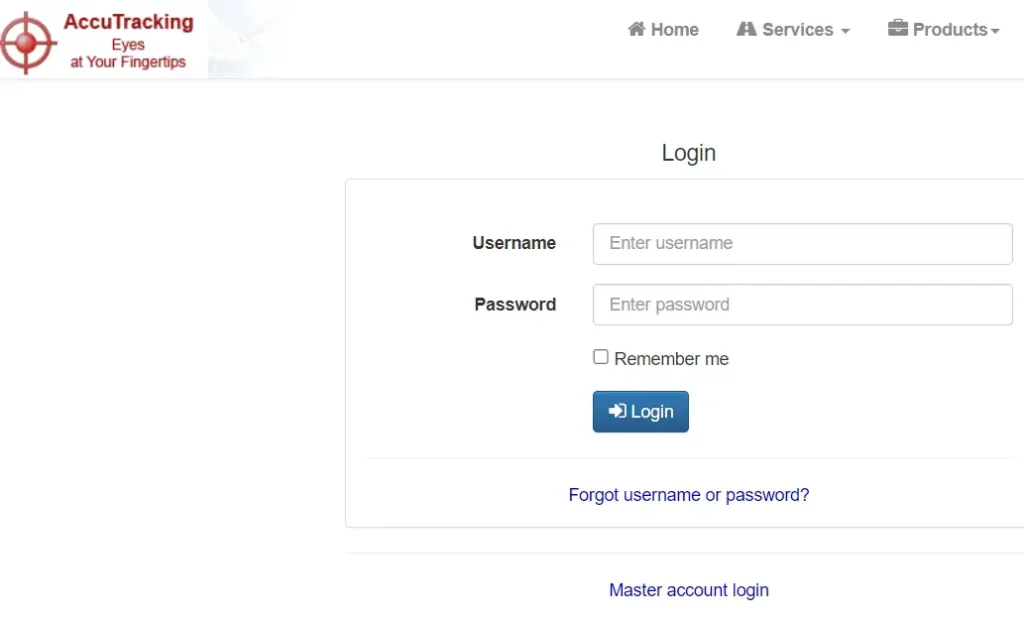

Accutrac Login

Accutrac Login is the process of accessing your account on the Accutrac web-based platform. Accutrac is a versatile platform that provides monitoring and tracking solutions for businesses, schools, and government agencies. It allows users to access and manage important information such as employee attendance, student attendance, and inventory, from anywhere with an internet connection. In this article, we will guide you through the Accutrac login process, highlight the benefits of using the platform, and answer some common questions.

How Does Accutrac Factoring Work?

Accutrac Factoring works by purchasing a business’s outstanding invoices at a discount. Once the invoices are purchased, the business receives immediate cash, which can be used for various purposes, such as payroll, inventory, and equipment purchases.

Fees and Charges of Accutrac Factoring

Accutrac Factoring charges a fee for its services, which is typically based on the amount of the invoice, the creditworthiness of the customer, and the length of time it takes to collect the invoice. The fee ranges from 1% to 5% of the monthly invoice.

Eligibility for Accutrac Factoring

Accutrac Factoring provides factoring services to businesses that meet the following criteria:

- The business must sell goods or services to creditworthy commercial customers.

- The business must have invoices that are payable within 90 days.

- The business must not have any outstanding liens or judgments.

Benefits of Accutrac Factoring

Accutrac Factoring provides several benefits to businesses, such as:

- Cash flow

- No debt

- No collateral

- Credit protection

- Faster collections

What are the fees associated with Accutrac Factoring?

Accutrac Factoring fees vary depending on the volume of invoices and the creditworthiness of the clients. The fee typically ranges from 1-5% of the invoice value.

Who can benefit from Accutrac Factoring?

Accutrac Factoring can benefit any business that invoices clients and experiences cash flow problems due to slow payment. This includes manufacturing, staffing, transportation, and service businesses, among others.

Conclusion

Accutrac Factoring is a valuable financial service that provides immediate cash flow to businesses by purchasing their outstanding invoices. It offers several benefits, including improved cash flow, no debt, no credit checks, improved credit rating, and outsourcing of the collection process. Any business that invoices clients and experiences cash flow problems due to slow payment can benefit from Accutrac Factoring.

Read More: