WHAT IS piggyvest

https://www.piggyvest.com/

An online tool called PiggyVest, formerly known as piggybank.ng, assists users in setting aside money for future aspirations. Additionally, the platform gives users the chance to invest their money in a variety of businesses and receive returns of up to 25% for a period of 8 months or longer. A savings account can earn up to 13% interest. 16-Feb-2022

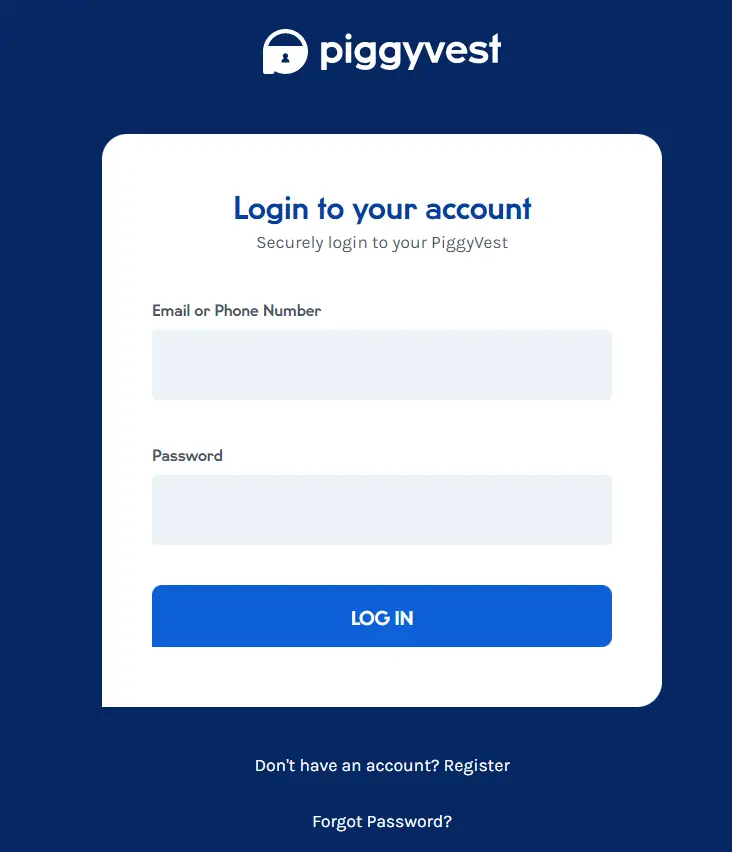

piggyvest LOGIN

https://app.piggyvest.com/login

Go to piggyvest login Link: https://www.piggyvest.com/. Then, Enter your Create an Account Instead Forgot Password?. click on the “login” button

PiggyVest sign up

https://dashboard.piggyvest.com/register

Starting your PiggyVest savings: To register, go to the website or download the app. Set up the information for your withdrawal account; this is the bank account to which the money you withdraw will be paid.

PiggyVest app

https://play.google.com/store/apps/details?id=com.piggybankng.piggy&hl=en_IN&gl=US

The AIICO Capital, a leading asset management firm in Nigeria, manages all monies stored by users of the Piggyvest app, making it secure. Additionally, Piggyvest included suitable security precautions when use the app.

PiggyVest News

https://www.ripplesnigeria.com/hackers-steal-n2-36m-from-piggyvest-customers-accounts-firm-says-it-cant-help/

The Central Bank of Nigeria (CBN) has given the fintech company authorisation in principle (AIP) to operate as a mobile money operator (MMO) in order to promote digital payments and inclusion for microbusiness owners in Nigeria as a result of the purchase.

PiggyVest customer care

https://www.piggyvest.com/terms

By contacting us at contact@piggyvest.com or 0700 933 933 933 and providing sufficient information for us to authenticate your identity, you may discontinue using the Services, close your PiggyVest Account, and cancel these Terms at any time. 15-Feb-2016

piggyvest review

https://www.trustpilot.com/review/piggyvest.com

Piggytech Cooperative Multipurpose Society Limited, another recognised cooperative, is in addition to Piggyvest (Registration number, 16555).

piggyvest customer care whatsapp number

https://www.piggyvest.com/terms

There is NO maximum limit on the minimum withdrawal from your piggybank, which is N3000. Anytime you choose, you can take out all of your money.

piggyvest nairaland

https://www.nairaland.com/6307474/piggyvest

The Central Bank of Nigeria (CBN) has given the fintech company authorisation in principle (AIP) to operate as a mobile money operator (MMO) in order to promote digital payments and inclusion for microbusiness owners in Nigeria as a result of the purchase. 09-Jul-2022

piggyvest safelock

https://www.piggyvest.com/safelock

The SafeLock function is ideal for you if you’re searching for anything long-term. Higher interest rates could allow you to store money you…