Ispar Income Tax department registered users apna login kar sakte hain. Yeh income tax returns file karne aur tax related services lene ke liye hai.

Homepage par top right corner mein ek “Login” option hai. Uspar click karke aap login ya register kar sakte ho.

Agar aap registered user nahi ho to aapko sign up karna hoga. Sign up ke liye aapko apna details daalna hoga jaise name, email ID, phone number etc.

Ek baar sign up ho jane ke baad aap login kar sakte ho apne user ID aur password se. Yaha aap aapna PAN details de sakte ho, income tax returns file kar sakte ho, tax payments kar sakte ho aur income tax department se related services avail kar sakte ho online.

Iske alawa yeh website tax laws, guidelines jaise helpful resources bhi provide karti hai login ke bina bhi. Lekin login karne se aapko aur bhi specific aur customized services milenge.

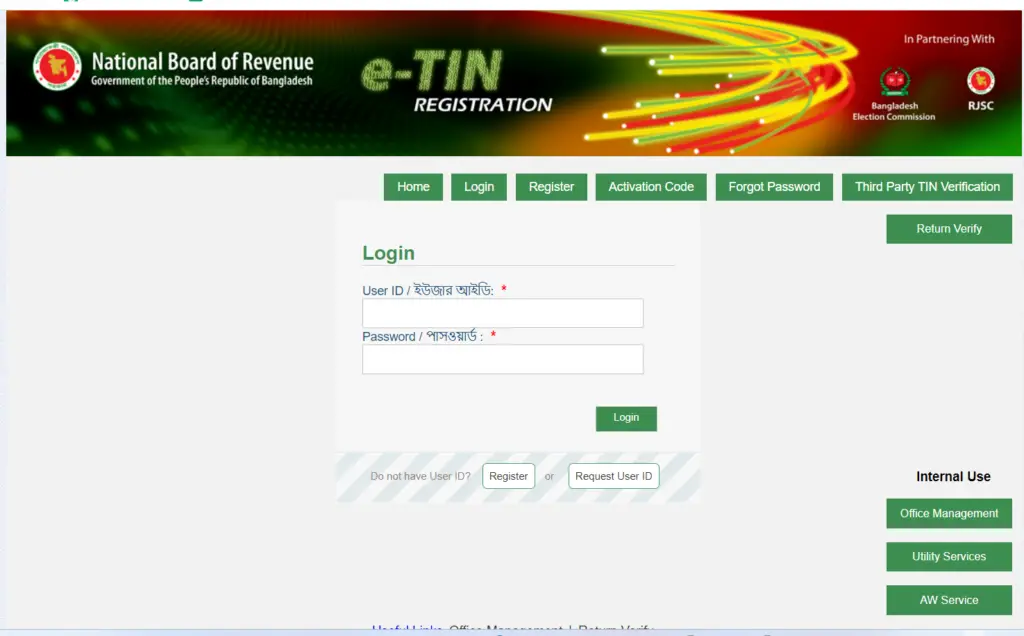

etin login

https://secure.incometax.gov.bd/Registration/Login

Visit the etin login link https://secure.incometax.gov.bd/Registration/Login Then enter sign in, password. Click on the “login” button

etin Registration

https://secure.incometax.gov.bd/Registration/Index

entre you user id ,password,retype password,Country,Security Question,Email Address,Verification letters,

etin certificate

https://secure.incometax.gov.bd/TINHome

The National Board of Revenue provides the electronic taxpayer identification number (e-TIN) (NBR).

etin full form

https://www.taxact.com/support/1411/2012/definitions-government-issued-numbers-efin-ero-etin-ein-itin-ptin-and-tin

E-TIP Number (ETIN) A 5-digit identifier provided by the IRS to e-file participants who transmit and/or produce software. TaxACT is ETIN-compliant. If a customer doesn’t file their own taxes, they won’t use their

etin bd

https://secure.incometax.gov.bd/TINHome

National Board of Revenue issues e-TINs (NBR). According to the Income Tax Ordinance 1984, every entity (individual or corporate) must have a Tax Identification Number.

etin payment

https://onlineservices.tin.egov-nsdl.com/etaxnew/tdsnontds.jsp

The ability to pay income taxes online using net-banking is a service made available to taxpayers.

etin certificate

https://secure.incometax.gov.bd/TINHome

National Board of Revenue issues e-TINs (NBR). According to the Income Tax Ordinance 1984, every entity (individual or corporate) must have a Tax Identification Number.

e tin certificate download by nid number

https://en.eservicesbd.com/tin-certificate-download-by-nid-number/

Fill out the online TIN Registration form to create and download an e-TIN. Secure incometax gov bd has TIN certificates. Verify account and mobile OTP. Click TIN Application and apply for e-TIN.

etin number

https://germantaxes.de/tax-tips/find-etin/

E-TIP Number (ETIN) A 5-digit IRS identification number provided to e-file participants who.

Read more: