Intrastat Login is the system used by the UK government to collect trade statistics between the UK and other EU member states.

Companies that meet certain thresholds are legally required to submit monthly declarations providing details of their intra-EU trade.

This data helps compile overall statistics on the UK’s import and export activities.

If your business trades with EU countries and exceeds the Intrastat thresholds, you must report your trade figures regularly through the online Intrastat login system.

This article provides an overview of how to gain access and submit your Intrastat declarations online.

what is intrastat?

http://www.intrastat.ro/intrastat/

Mastering Intrastat Login is an essential step in optimizing your international trade data reporting. The streamlined process, compliance benefits, and data-driven insights empower your business to navigate the complexities of global trade seamlessly.

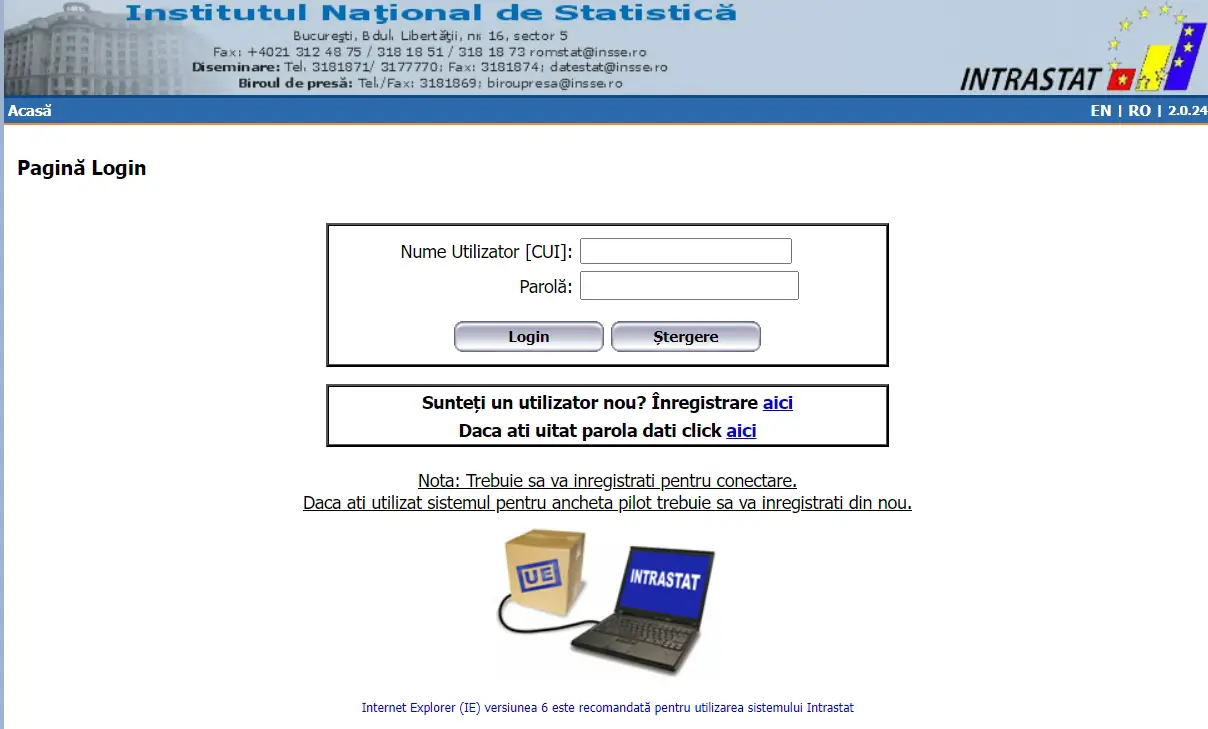

intrastat login

http://www.intrastat.ro/intrastat/free/login.jsf

Visit the HM Revenue & Customs online Intrastat System login page. http://www.intrastat.ro/intrastat/free/login.jsf enter your username and password.

intrastat meaning

http://www.intrastat.ro/intrastat/

Intrastat is the data collection system for compiling statistics on international trade in goods between the European Union (EU) Member States.

intrastat report

http://www.intrastat.ro/intrastat/

Intrastat is the system for collecting information and producing statistics on the trade in goods between countries of the European Union. The Intrastat reporting is a monthly obligation for those companies moving goods across the EU which surpass those countries reporting thresholds.

intrastat code

http://www.intrastat.ro/intrastat/free/login.jsf

The Intrastat code is an 8-digit code to divide goods into categories.

intrastat declaration

http://www.intrastat.ro/intrastat/

An Intrastat Declaration is a report outlining transport of goods between two EU Member States that must be submitted by relevant persons in terms of Subsidiary Legislation 406.18.

intrastat threshold 2023

http://www.intrastat.ro/intrastat/

Intrastat Thresholds 2023: What are the changes in Intrastat thresholds between 2022 and 2023? The threshold for introduction increases from 280,000 euros to 500,000 euros.

intrastat configuration in sap

http://www.intrastat.ro/intrastat/

Integrating Intrastat with SAP (Systems, Applications, and Products) allows businesses to streamline the reporting process and maintain compliance with EU regulations.

intrastat process in sap

http://www.intrastat.ro/intrastat/

The Intrastat process in SAP (Systems, Applications, and Products) offers a sophisticated solution to streamline trade reporting, enhance transparency, and ensure compliance with EU regulations. This guide dives into the intricacies of the Intrastat process in SAP, providing insights into setup, data extraction, reporting, and compliance.

Who Needs an Intrastat Account?

Any UK business engaged in buying and selling goods with other EU member states may need to register for Intrastat if they meet either of these thresholds:

- Arrivals (EU imports): £1.5 million or more per year

- Dispatches (EU exports): £250,000 or more per year

Once you cross either threshold, you have to submit monthly Intrastat returns even if your trade figures fall below the limits again.

Getting Help with Intrastat

If you face any issues with the Intrastat login or filing process, contact the Intrastat helpdesk at 0300 200 3700 or intrastatenquiries@hmrc.gov.uk. You can also find guidance materials and online webinars on www.uktradeinfo.com.

Submitting Intrastat declarations through the online portal allows businesses to conveniently meet their legal obligation for reporting EU trade statistics.

Follow the steps outlined in this article to access your Intrastat account and start compiling your monthly returns digitally.

Read More: