What Are PF Accounts & PF Transfers?

It means the public provident fund. The PF account is used only by employees. Employee Provident Fund organization, especially relevant to establish for employers. It was working only for Employees related. So the PF account provides only EPFO. It is an Employee related organization. PF transfer Login portal in recently introduced by EPFO

How to work PF Account?

It’s provided only to employees by EPFO. Since it has been working since 1952, it seems like an umbrella. Every Employee has only one PF account, the universal account (UAN). Employees every month contributed some amount to our salary and offered working companies. PF account is used to get loans like construction for homes and purchasing lands after retirement schemes are available.

Who’s transfer PF account?

Employee’s transferring one place to another palace as well as from one company to another company. This type of Employee transfer her PF account. The PF transfer process is quick and easy online.

PF Claim Status And PF Withdrawal

How To Move the PF account in old PF funds?

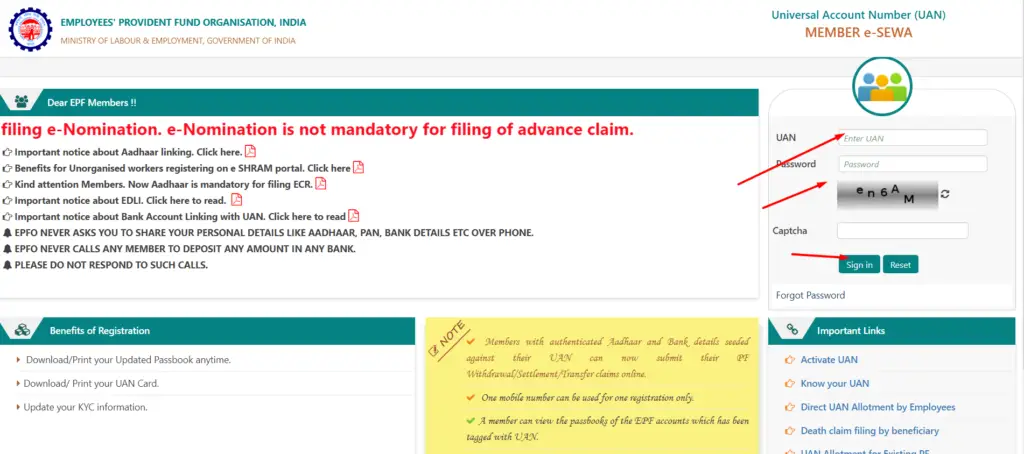

Employment Provident Fund (EPFO) has recently introduced PF transfer portal. This portal is used to transfer her PF account and PF funds quickly. Every Employee shares our PF account easily and quickly. In this corner, the figure is PF transfer image and follow the below steps.

- Open this web site: https://unifiedportal-mem.epfindia.gov.in/

- Display same as left side fig. we see the left corner on window MEMBER LOGIN.

- Here, you are selecting one document. for Example, PAN number, Aadhar (UID), National Population registered, Bank account number, Voter ID card, Driving license, Passport number, and Ration card number.

- In the below field will be entered the same as the above-selected document number.

- Hence, enter your registered mobile number.

- Finally, click the sign-in button.

After signing on this page, your request form opens, then fill up and submit all details. Now you have offered the hard copy details from your HR in the company.

Read Also: Myacpny Login

How To Check The Eligibility Form For Applying For PF Transaction Of PF Claim?

First of all, Employee has been checking the eligibility process after registering for the PF transfer claim portal; then, after login into this portal to request a transfer PF account and submitting a hard copy in your HR department.

The below steps follow to check your eligibility criteria quickly.

- Visit https://www.epfindia.gov.in/site_en/OTCP_ForEmployers.php the Online transfer claim portal (OTCP)

- Click check eligibility for the claim

- After the open window is Check Eligibility for Applying For An Online Transfer Claim

- See below for Details of the Previous Account (Which is too transferred)

- Same as fig. Enter filed has PF ACCOUNT NO MAINTAINED WITH EPFO OFFICE in this bold sentence means to select your PF account state and city of office, then enter EST CODE and EXT and enter PF account.

- While we see Details of the current account, the following field is PF account NO and Maintained by the EPFO office.

- Same as fill up above step.

- Click check eligibility

Finally, you got eligibility information on display.

How to register for the PF transfer form?

Every, Employee mandatory register her PF transfer claim status.

Now, you follow my instruction to quickly registered in your PF transaction claim status form.

- open website: https://registration.shramsuvidha.gov.in/user/register

- display the member portal page. Below (* mark) is compulsory fields.

- Enter your mobile number

- Date of Birth

- select any document, for Example, PAN card, Ration card, Voter ID, Etc.

- enter the number on the document

- Name as on a document

- Enter Email

- Type the characters shown in the text box

- Click on the GET PIN button to get the authorization PIN on your mobile number

- same as SMS PIN submit and agree.

Finally, you got a successful register on display.

Regular can login and ePFo login not required for PF transfer.

I forgot your submitted document and number recovery method

Sometimes employees, which one document and number entered in registration time forgotten.

The below steps follows to recover your document details.

- Open PF transfer claim status website.

- On The member portal login page below text, click Forgot Login?

- Open a new window on the member portal. Enter registered mobile number and submitted,

- Now you got the message on a registered mobile number and get the details of your PF transfer registered time given document details

- Above same, as follows and login to send a request of PF transfer.

Note: for automatic PF transfer from the previous company to the current company. Just inform the man number & last member id to a new employer.

EPF transfer claim status checking process

An employment provident fund organization provides withdrawals and PF transfers, passbook downloads, ePF balance checking, and more.

Employees requested to claim for ePF account or PF transfer. It requires the status-checking process below.

- Visit the EPFO portal

- And click on Know your status

- Now enter the regional PF state and city

- And also enter EST CODE (establishment code)

- Then enter the PF account number and enter the 3-digit code of the PF account number

- Submit and then display your claim ID code.

- PF claim ID once you have checked in so many times in used to claim ID

- Therefore, check your claim status in various types like the mobile app, Online UAN portal, EPFO portal, etc.

- Compare the online process and offline process befits

Since The 1952 year before launching the online process to employees has had many risks. Fill out the manual paper and go to PF office and submitted, waiting for so many days. Nowadays, employees sitting on the system open the EPFO portal and fill up the form and submit and take a hard copy then will send HR Group, in a few days to claim or transfer our PF.

See Also: Badoo Sign Up

Once a day, use the manual form for PF claim only. It is physical and filled manually after submitting it to the present employer, HR, or our boss. This employer forward to the regional PF office, then after the verification process is completed, forwards the application form to the company of the previous employer. This application was verified by HR. Next, we will send the account number money to the regional office. These all are the transfer from one place to another place lot of time-wasting process. This time and risk to reduce to the lunch EPFO portal by EPFO

But nowadays, Employment provident fund organizations make to introduce online claims, and PF transfer portal has been released. This portal use quick clime and PF transfer.

Online PF transfer benefits

- PF claim form does not travel from one place to another and only fills out the online form.

- PF form verification process completed in an online-only, but not travel the PF state office

- The manual process of money is given time, so login because travel between two offices.

- The online claim process is quick, and you track your PF transfer claim status using the claim code.

Employees follow some rules given below.

Every Employee must and should work a minimum of six months after their eligibility for withdrawal. Necessarily work for one company eligible for loans and pension schemes.

In case of any emergency withdrawal in PF account, follows the below steps

- log in to the claim portal page link: https://www.relakhs.com/epf-online-transfer-claim-otcp-uan-member-portal/

- Once you login to this site, click claim online

- In this portal, also available Complaint regarding the provident fund; these form uses to reduce your issue

- Then, at solving the EPFO employers.

- But Every Employee working in the current company after you will withdraw the money. Then in the case before, you will apply for PF

- withdrawal refused or rejected by the employer of EPFO.

However, an employer in any urgent situation is not given money 100%. Maybe your age is 57 and above-given money 100%; otherwise, claim only 90%. Employees who withdraw money in working before five years will be taxed because you’re working five years after withdrawal tax-free.