Spotloan offers online personal loans with fixed payments and flexible repayment options. To manage your Spotloan account, you need to log in to your account dashboard. This guide will outline the Spotloan login process, account management features, loan resources, and tips for a smooth borrowing experience.

WHat is Spotloan?

Spotloan is an online lending platform owned and operated by BlueChip Financial, a tribe-owned entity on sovereign Native American land. They provide access to fixed-rate, fixed-payment personal installment loans with flexible repayment options.

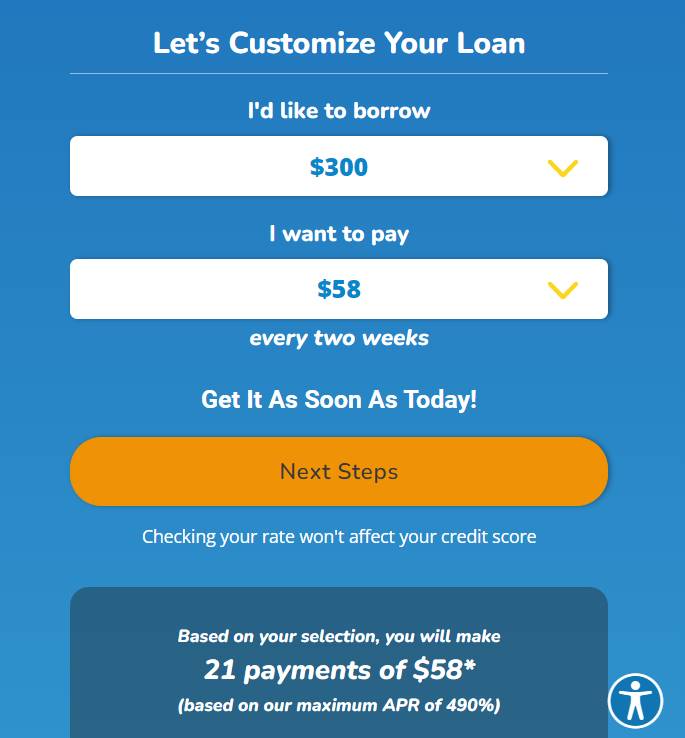

Unlike payday loans, Spotloan’s installment loans allow borrowers to pay back the principal and interest in multiple payments over time instead of a single payment by the next paycheck. Loan amounts range from $300 to $800 with repayment terms between 2 – 12 months.

spotloan login

https://www.spotloan.com/

Go to the Spotloan login page: https://apply.spotloan.com/account/sign-in. Enter your email address and password. Click the “Sign In” button.

Spotloan lawsuit

https://www.spotloan.com/

The Spotloan lawsuit is a reminder that payday lenders and other small-dollar loan lenders are often predatory companies that charge excessive interest rates and trap borrowers in a cycle of debt. If you are considering taking out a small-dollar loan, it is important to shop around and compare interest rates from different lenders. It is also important to read the fine print carefully before signing any loan agreement.

Spotloan phone number

https://www.spotloan.com/contact-us

Spotloan’s phone number is (888) 681-6811. Their hours of operation are Monday–Friday 7 AM–8 PM CT and Saturday 9 AM–6 PM CT. You can also contact Spotloan by email at help@spotloan.com.

Spotloan reviews

https://www.trustpilot.com/review/www.spotloan.com

Spotloan is a small-dollar loan lender that offers loans of up to $800 to borrowers with bad credit. Spotloan loans have high interest rates, typically ranging from 490% to 780%. Spotloan has been criticized for its predatory lending practices, and it has been the subject of numerous lawsuits.

spotloan apply

https://www.spotloan.com/

Go to the Spotloan website: https://www.spotloan.com/ Click the “Apply Now” button. Enter your personal information, including your name, address, date of birth, and Social Security number. Spotloan will review your application and make a decision within minutes. If you are approved, you will receive your loan funds within one business day.

spotloan alternatives

https://www.spotloan.com/

A Spotloan alternative is a short-term loan product that has lower interest rates and fees than Spotloan loans, and may also offer longer repayment terms. Spotloan alternatives are designed to help borrowers avoid the high interest rates and fees associated with Spotloan loans, and to provide borrowers with a more affordable and sustainable way to borrow money.

spotloan business hours

https://www.spotloan.com/

If you accepted your loan terms on a Monday through Friday, before 11:30 a.m. CT, Spotloan will transfer the money to your bank by the end of the business day. If you accepted your loan terms on a Monday through Thursday between 11:30 a.m. CT and 8 p.m. CT, Spotloan will transfer your funds to your bank overnight.

spotloan legit

https://www.spotloan.com/

Spotloan is a legitimate company, but it has a mixed reputation among borrowers. Spotloan is a small-dollar loan lender that offers loans of up to $800 to borrowers with bad credit. Spotloan loans have high interest rates, typically ranging from 490% to 780%. Spotloan has been criticized for its predatory lending practices, and it has been the subject of numerous lawsuits.

spotloan application

https://www.spotloan.com/

You can apply for a Spotloan online. Spotloan is a brand that offers short-term installment loans. You can apply for a Spotloan even if you have bad credit.

spotloan reviews bbb

https://www.spotloan.com/

Spotloan has a F rating with the Better Business Bureau (BBB). The BBB is a nonprofit organization that provides ratings and reviews of businesses. The BBB’s rating system is based on a number of factors, including the number and severity of complaints, how the business responds to complaints, and the business’s overall business practices.

How Spotloan Works

https://www.spotloan.com/

Visit the Spotloan website and enter the loan amount and state of residence to begin. Provide basic personal information including name, contact details, date of birth, and social security number. Enter your income source and bank account information for verification. Review and e-sign the loan terms, disclosures, and electronic debit authorization. After submission, you receive an instant loan decision – often in minutes. If approved, the loan funds ($300 – $800) are deposited directly into your bank account as quickly as the next business day.

Conclusion

The Spotloan login allows complete access to your personal loan account, balance, payments and support tools all in one place. Following the simple login process using your email and password provides access anytime.

Responsibly managing your account ensures you remain updated on your loan while taking advantage of resources to be a successful borrower. Logging in regularly enables you to take control of your loan and finances.

Read More:

![Srfax Login: Forgot Password At www.srfax.com [Click Here]](https://logintutor.org/wp-content/uploads/2022/08/Srfax.com-Login-1024x724.png)