Your TransUnion Login credit report contains highly sensitive financial information that has a major impact on your ability to obtain loans, mortgages, credit cards and other lines of credit. As such, it’s crucial to regularly check your TransUnion credit report in order to ensure maximum accuracy and protect against potential identity theft.

What Is Transunion?

TransUnion is an international provider of credit reports, consumer reports, and other consumer data and analytics. By ensuring that every customer is fairly represented in the market, it fosters trust between businesses and their clientele TransUnion Login. As a means to this end, we ensure that we have an accurate portrait of each individual to work with.

If you sign up for TransUnion Credit Monitoring and pay for it, you may rest easy knowing that your credit is being monitored. A membership to TransUnion Credit Monitoring provides you with easy access to comprehensive resources regarding your credit report.

TransUnion and VantageScore® 3.0 credit scores between 720 and 780 are considered excellent. Your options will open up as your credit score rises into this area and beyond. There are others that want to achieve the maximum attainable score of 850.

Consumers shouldn’t expect lenders and creditors to evaluate their creditworthiness based on their Equifax score. Instead, many lenders rely on FICO Scores® to determine an applicant’s creditworthiness. FICO calculates a credit score by combining information from all three major credit bureaus, including Equifax, TransUnion, and the other two.

Since numerous credit score manufacturers, score variants, and score generations coexist in the real world, this is the case. These factors will likely result in different credit ratings even if your credit report is identical at all three credit bureaus (which is also uncommon).

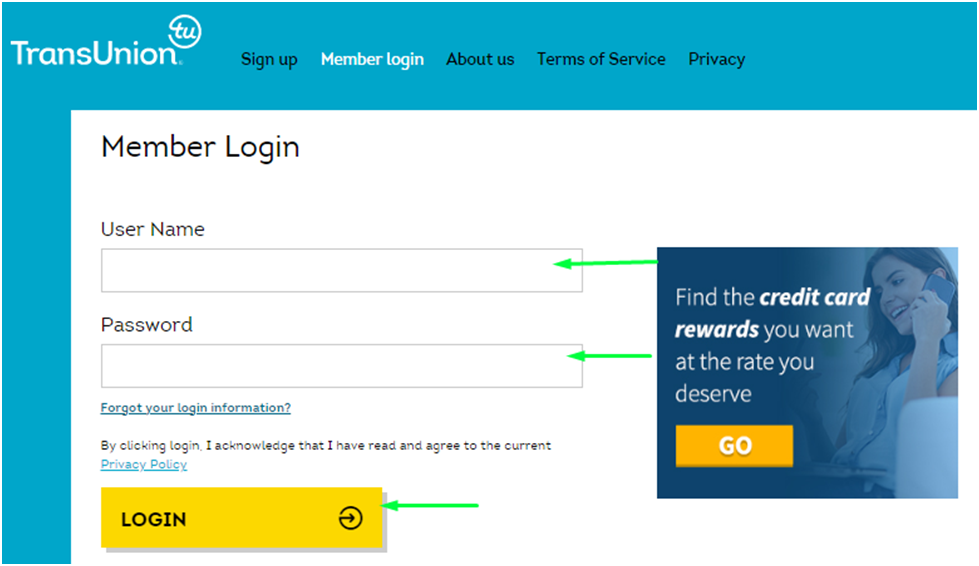

How To Login Step In Transunion?

Step #1: Open a web browser and type in the TransUnion login URL.

Step #2: Fill out the fields for “User Name” and “Password.”

Step #3: Click on the “Login” button.

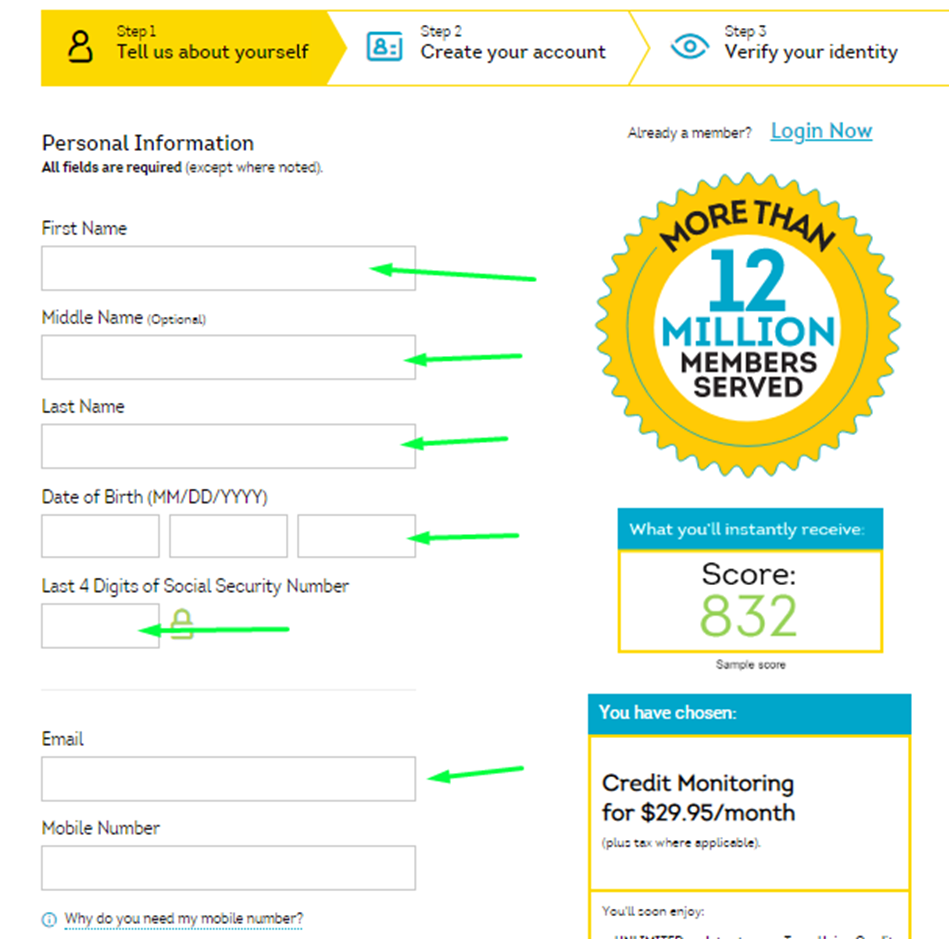

How To Create Account sunion?

Step #1: Open a web browser and type in the TransUnion register URL.

Step #2: Fill in your “First Name,” “Middle Name,” “Last Name,” “Date of Birth,” “Last 4 Digits of Social Security Number,” “Email,” “Mobile Number,” “City,” and “State.”

Step #3: Click the button that says “Continue.” On the next page, you’ll be asked for your email address, a password, and other information.

Follow the steps to finish the job. After signing up, go to the login page and enter your login information to get to your TransUnion login account.

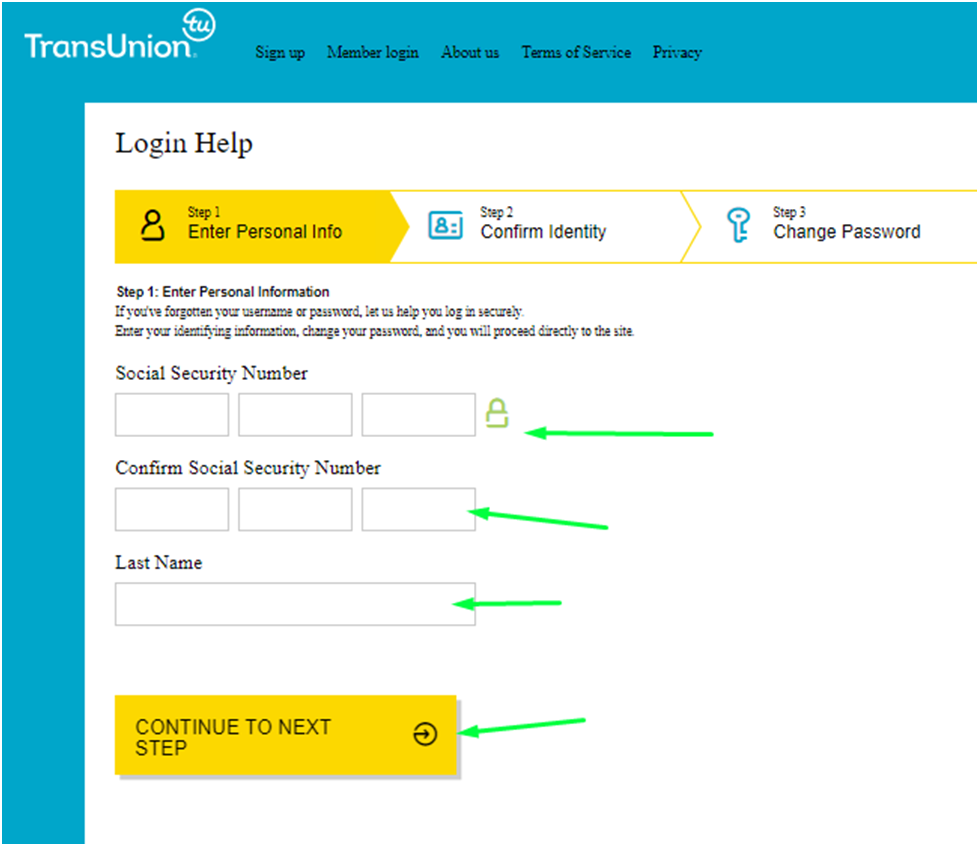

How To Reset Password Transunion?

Step #1: Type the Reset TransUnion password URL into a web browser.

Step #2: Enter your “Social Security Number,” “Confirm Social Security Number,” and “Last Name” in the fields provided.

Step #3: Click “Continue and Next Step.” The system will check your information and send you a link to reset your password to the email address you used to sign up. Go to your email and click on the link to see what to do to finish the process.

Once the password is reset, go to the login page and enter a new password to get into the TransUnion account.

Transunion Phishing Techniques

In the digital world, there are a lot of ways you can put yourself at risk by giving out private information online. Find out more about each of these ways to protect your online identity.

Transunion Phishing

Phishing is trying to get sensitive or personal information like login credentials, banking and card information, or even personal identifiers like your PAN and AADHAR number by tricking you, like by pretending to be someone else in an electronic message. Cybercriminals use this to trick users into giving up sensitive, private information by sending them fake emails and websites.

Related Searches

- transunion login credit freeze

- transunion login canada

- transunion login south africa

- transunion login page

- transunion login not working

- transunion login uk

- transunion login dispute

- transunion login free credit report

- transunion login free

- cibil transunion login

Contact Us

Consumer Helpline Number:

+91 – 22 – 6140 4300

Fax: +91 – 22 – 6638 4666

REGISTERED CORPORATE OFFICE

TransUnion CIBIL LTransUnion Login is a global information and insights company that operates in more than 100 countries, providing solutions for consumer credit,imited

(Formerly: Credit Information Bureau (India) Limited)

One Indiabulls,

19th Floor, Tower 2A-2B,

Senapati Bapat Marg, Elphinstone Road,

Mumbai 400 013.

Tel : +91 – 22 – 6638 4600

FAQs

What is TransUnion used for?

The three biggest credit bureaus in the U.S. are TransUnion, Experian, and Equifax. It is their job to collect and keep track of consumer credit reports. Then, these reports are sent to people who have paid for them, like landlords, mortgage lenders, credit card companies, and other businesses that use them to decide whether or not to give you credit.

What does TransUnion mean on your credit?

TransUnion is a big company that makes credit reports. Credit reports help lenders and other businesses decide who to lend money to. By keeping an eye on your credit reports, you can see how your credit is doing and make sure there are no mistakes.

Transunion

https://www.transunion.com/

TransUnion is a global information and insights company, best known for its role as one of the three major credit reporting agencies in the United States, alongside Equifax and Experian. They collect and aggregate information on over one billion individual consumers in over thirty countries, providing credit scores, reports, and other data-driven insights to businesses and consumers alike.

Transunion Login

https://www.transunion.com/customer-support/login

Visit the official TransUnion website https://www.transunion.com/customer-support/login. Provide your username and password. Click on the “Log in” button.

TransUnion free credit report

https://www.transunion.com/annual-credit-report

You can request a free copy of your TransUnion credit report once a year from AnnualCreditReport.com. You can also request a copy by calling 1-877-322-8228 (TTY: 1-800-821-7232).

TransUnion CIBIL login

https://consumer.cibil.com/

Visit the TransUnion CIBIL login page at. Provide your username and password. Click on the “Log in” button.

TransUnion dispute

https://www.transunion.com/

TransUnion dispute is a process of correcting errors on your credit report. If you find an error in your TransUnion credit report, you can dispute it by following the steps provided on the TransUnion website. You can file a dispute online, by mail, or by phone. The online dispute process is the quickest and most efficient way to dispute errors.

transunion credit freeze

https://www.transunion.com/credit-freeze

A credit freeze, also known as a security freeze, is a free and easy way to protect yourself from identity theft. It prevents third parties from accessing your credit file without your consent.

transunion customer service

https://www.transunion.com/client-support/business-support-services#

You can contact TransUnion’s consumer helpline at +91-22-6140-4300, Monday through Friday, 10 AM–6 PM. You can also fax them at +91-22-6638-4666.

transunion customer service phone number

https://www.transunioncibil.com/about-us/contact-us

Phone: 800-813-5604.

transunion cibil score

https://www.transunion.com/

TransUnion CIBIL Limited is a bureau that monitors and tracks credit histories and issues credit scores. These scores range from 300 to 900 and represent an individual’s creditworthiness.

transunion cibil meaning

https://www.transunion.com/

CIBIL stands for Credit Information Bureau (India) Limited. In 2000, CIBIL partnered with US-based TransUnion.